Digital Mortgages 3.0: What Every Broker Needs to Know Now

The mortgage industry has evolved rapidly as digital mortgages become the new standard. Moreover, with advances in online applications, e-signatures, secure document portals, and automation, digital mortgage experiences now rival consumer apps for speed and clarity. Therefore, for brokers, the priority is understanding what’s coming next and how to adapt effectively.

Digital mortgages refer to modern mortgage processes completed online using secure, automated technology—from initial application through final approval.

What Is a Digital Mortgage?

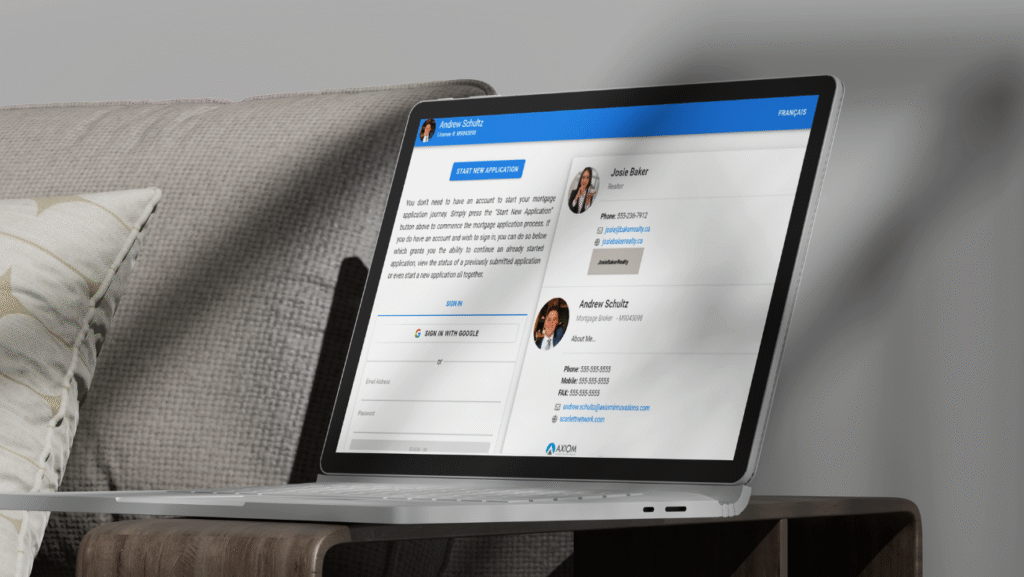

A digital mortgage is a technology-enabled home loan process that simplifies the borrower and broker journey. It includes online applications, e-signatures, document collection, automated credit checks, real-time status updates, and audit trails. In addition, the digital approach reduces manual errors and accelerates underwriting readiness.

Instead of chasing paperwork or waiting on manual approvals, borrowers can complete most steps online. Consequently, brokers gain faster turnarounds, fewer repetitive tasks, and more time for consultative guidance. As a result, firms often see measurable gains in client satisfaction and referral potential.

Why the Future Is Digital

Consumers expect the same convenience from financial services that they enjoy in streaming, food delivery, and e-commerce. Therefore, homebuyers want to apply from their couch, sign documents digitally, and receive prompt updates without endless email threads.

Lenders and technology partners are responding by investing in automation, AI, and data security. Moreover, this shift creates opportunities for brokers who adopt tools that streamline intake, accelerate document review, and enhance compliance. Consequently, early adopters are improving cycle times while preserving a white-glove client experience.

Key Trends Shaping the Future

AI and Automation

AI helps brokers pre-qualify faster and more accurately. For example, automated systems analyze income documents, flag missing items, and surface potential issues early. Learn how Scarlett Genius uses AI to streamline broker workflows and support smarter deal placement.

Open Banking

With borrower consent, open banking enables secure, real-time access to verified financial data, thereby reducing manual paperwork and increasing accuracy.

Personalization Through Data

As platforms collect richer borrower insights, brokers can tailor recommendations and lending options. Notably, Scarlett Network helps convert client data into timely, relevant guidance.

Increased Transparency

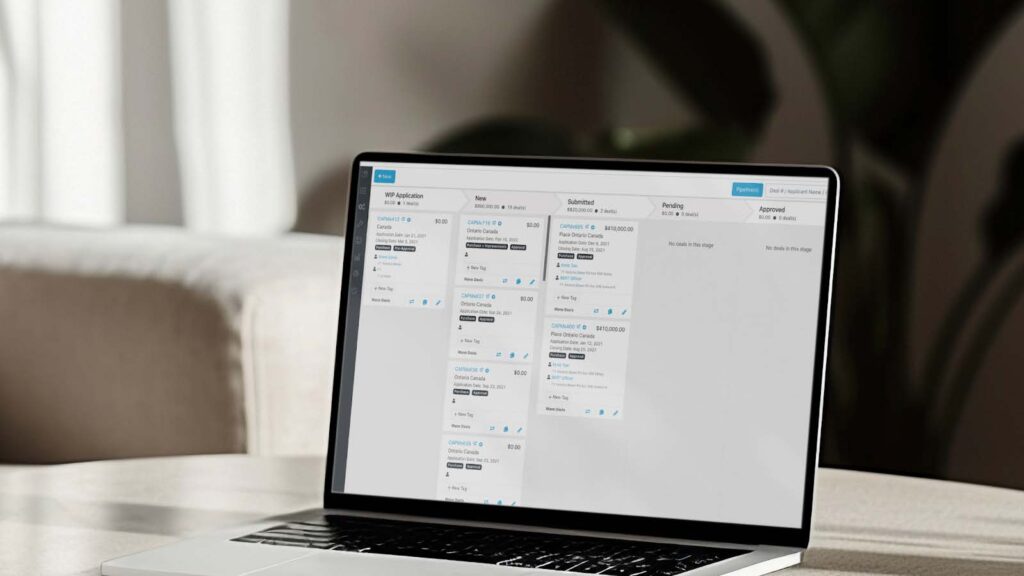

Borrowers want to see exactly where they are in the process. Consequently, real-time dashboards and progress trackers are becoming essential. The Client Mortgage Application provides live status tracking for brokers and borrowers alike.

Enhanced Security & Compliance

With more sensitive data moving online, protection and compliance remain top priorities. Scarlett Pay simplifies broker payroll and supports FINTRAC requirements via secure, auditable flows. For broader regulatory context, review OSFI innovation resources and the Department of Finance Canada updates.

What Brokers Should Start Doing Now

1) Embrace the Technology

Adopt high-impact tools first: e-signatures, secure document portals, and an integrated mortgage platform. Consequently, your team gains time for client strategy instead of admin work.

2) Focus on Education

Clients still value human guidance. Therefore, explain how automation and security protect their data and speed approvals. Meanwhile, explore Training & Education for up-to-date lessons, walkthroughs, and best practices.

3) Partner with the Right Platforms

Select providers that evolve with industry changes. The best offer regular updates, compliance support, and deep integrations. Accordingly, see our latest product updates to understand ongoing improvements across Scarlett.

4) Keep the Human Touch

Digital tools accelerate tasks; however, empathy closes deals. Offer proactive check-ins, explain trade-offs clearly, and maintain a coach-like presence. For professional development options, visit Mortgage Professionals Canada.

For additional playbooks and market context, visit our Insights blog, explore industry solutions, or connect with our support team for implementation tips.

Frequently Asked Questions

Are digital mortgages secure?

Yes. Leading platforms employ encryption, role-based access, audit trails, and modern cloud controls to protect borrower and broker data. Moreover, strong vendor due diligence and internal policies are essential.

Do digital tools replace the broker’s role?

No. Technology automates routine tasks so brokers can focus on strategy, education, and long-term relationships. Ultimately, digital workflows enhance—not replace—trusted advice.

How can a brokerage get started quickly?

Begin with e-signatures and secure document intake; then add open-banking connections and AI document checks. As your team gains proficiency, expand into analytics and automated communications.

Looking Ahead

The mortgage process of the future is faster, more secure, and more transparent. Therefore, brokers who invest now in digital readiness are positioned to lead that change. By combining innovation with strong client relationships, you can deliver a seamless, trustworthy experience that meets modern borrower expectations.

Summary

In summary, digital mortgages are no longer optional—they are essential. By combining technology, education, and human connection, brokers can thrive in a market that rewards speed, transparency, and trust.

At Scarlett Network, we believe the future belongs to brokers who harness innovation to deliver human-centered digital experiences.

Resources: Products · About · Support