5 Proven Ways to Speed Up Client Approvals (and How Scarlett Network Makes It Seamless)

Waiting on client approvals? It is one of the biggest roadblocks mortgage brokers face. Delays in signing or reviewing documents can stall deals, add stress, and even risk losing business. Fortunately, approvals do not have to be a bottleneck. With the right tools, you can keep things moving quickly without cutting corners.

Here are five proven ways to speed up client approvals, plus how Scarlett Network makes it easier than ever.

1. Set Expectations Early

Clients want fast approvals, but they do not always realize how much their own timeliness impacts the process. Therefore, make it clear from the start when they will need to upload, review, and sign documents, and how delays can affect approval timelines.

With Scarlett: Automated email reminders keep clients on track, so you do not have to chase them down.

2. Keep Documents Clear and Organized

Overwhelming clients with too much paperwork at once can slow things down. Instead, give them clear instructions and keep everything easy to navigate. As a result, clients stay confident and move through approvals faster.

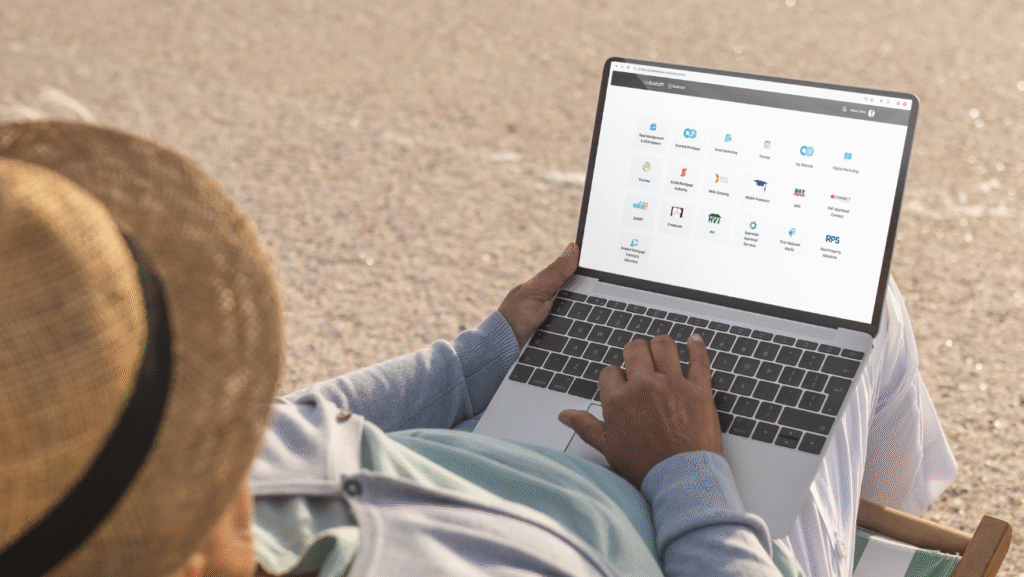

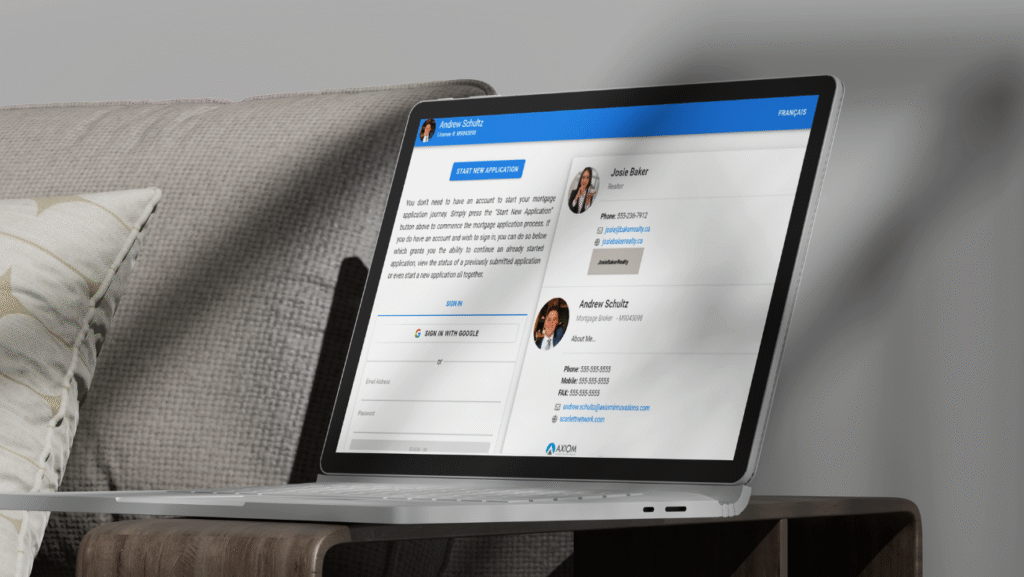

With Scarlett: Our platform organizes every document in one place, so clients see exactly what they need to review and sign—no confusion and no endless email chains.

3. Use E-Signatures for Speed

Printing, scanning, and emailing documents wastes precious time. In contrast, digital approvals are faster, safer, and more convenient for everyone. In addition, they create a more professional impression for your clients.

With Scarlett: Integrated e-signature tools let clients approve documents anytime, anywhere—straight from their phone or computer.

4. Follow Up Without the Hassle

Approvals often get delayed when reminders fall through the cracks. Consequently, staying on top of follow-ups is key to moving deals forward. Fortunately, automation can make that effortless.

With Scarlett: Built-in notifications and status tracking mean you always know where things stand, and clients get timely nudges to take action. For more on how Scarlett automates compliance and client management, visit Scarlett Pay.

5. Stay Compliant While You Move Fast

Speed does not mean skipping due diligence. Brokers need to ensure every deal meets FINTRAC and AML requirements, which can slow things down if managed manually. Meanwhile, technology can make compliance faster and more accurate.

With Scarlett: FINTRAC compliance is built right into the platform. From record-keeping and applicant verification to PEP, sanctions, and IDV checks, everything is streamlined. You save time, stay compliant, and keep deals moving without adding extra steps. For reference, learn more about FINTRAC requirements for mortgage brokers.

The Bottom Line

In conclusion, speeding up approvals does not mean sacrificing quality. With Scarlett Network, you get a seamless, professional process that saves time for both you and your clients. Ultimately, the result is faster deals, less stress, and a smoother client experience from start to finish, all while staying fully compliant. You can also explore our Support Centre for guides and training.

Learn more about Scarlett Network features or contact our sales team to see how we can help you move deals faster.

Keywords: Scarlett Network, mortgage broker software, speed up client approvals, digital e-signatures, FINTRAC compliance, AML verification, client document management, automated reminders.