Register here to attend one of our two

“REVUP YOUR REAL ESTATE REFERRALS” live sessions!

May 7th 10-11am

May 9th 2:30-3:30pm

Register here to attend one of our two

“REVUP YOUR REAL ESTATE REFERRALS” live sessions!

May 7th 10-11am

May 9th 2:30-3:30pm

Register here to attend one of the four “REFUEL YOUR RENEWAL PIPELINE!” live sessions!

March 26th 12-1pm

March 28th 12-1pm

April 2nd 3-4pm

April 4th 1-2pm

Register here to attend one of the two “REFUEL YOUR RENEWAL PIPELINE!” live sessions.

CLICK HERE TO REGISTER FOR OUR MORNING SESSION – March 12 @ 10 a.m.

CLICK HERE TO REGISTER FOR OUR AFTERNOON SESSION – MARCH 12 @ 3:30 p.m.

CMP ARTICLE

Dong Lee is embarking on a new adventure as the CEO of Axiom Innovations Inc. Lee brings a wealth of experience from his successful tenure at Mortgage Architects and DLC Group of Companies, now joining forces with longtime friend and Axiom president, Joseph Fakhri. With Lee’s expertise in sales and operations, coupled with Fakhri’s strength in product development and technology, the opportunities for growth at Axiom and Scarlett are immense.

Lee’s approach to his new role involves understanding the business and its culture before making any major changes. He’s excited to steer Axiom in the right direction and sees enormous potential in expanding strategic relationships and growing core products like Scarlett Mortgage and Scarlett Pay within the broker channel. Stay tuned for exciting developments as Lee leads Axiom into its next chapter!

#AxiomInnovations #NewCEO #BusinessGrowth #Partnership #LeadershipJourney

Scarlett came away with the Best Product or Innovation Award at this year’s Mortgage Awards of Excellence, an honour that founder and CEO Joe Fakhri (pictured top, right) described as an affirmation of its constant commitment to driving the mortgage process forward through technology.

“We’re happy and very proud of what the team has done – the fact that everybody has come together to rally around a common vision,” he told Canadian Mortgage Professional. “What it means is that all the innovation that we’ve put into the ease of use, speed of the system, and efficiency that it introduces to the mortgage space is paying off.”

Our latest release notes are now available. To read or download the complete notes in PDF form click the link below.

And remember…Don’t let your business run you. Run your business!

JAN_11_Release_Notes_Deck_1.1.7.24554

Joe and Andrew recently spoke with CMPTV about technology in the mortgage space and how it contributes to the accuracy and efficiency of a brokerage’s processes. Scarlett continues to evolve as the mortgage landscape continually changes to allow for brokerages, brokers and agents (and lenders) to do what they do best…close deals and provide mortgage solutions. Click the link below to Watch the full video interview!

HOW CAN TECHNOLOGY CONTRIBUTE TO PERFECTING A BROKERAGE’S PROCESS?

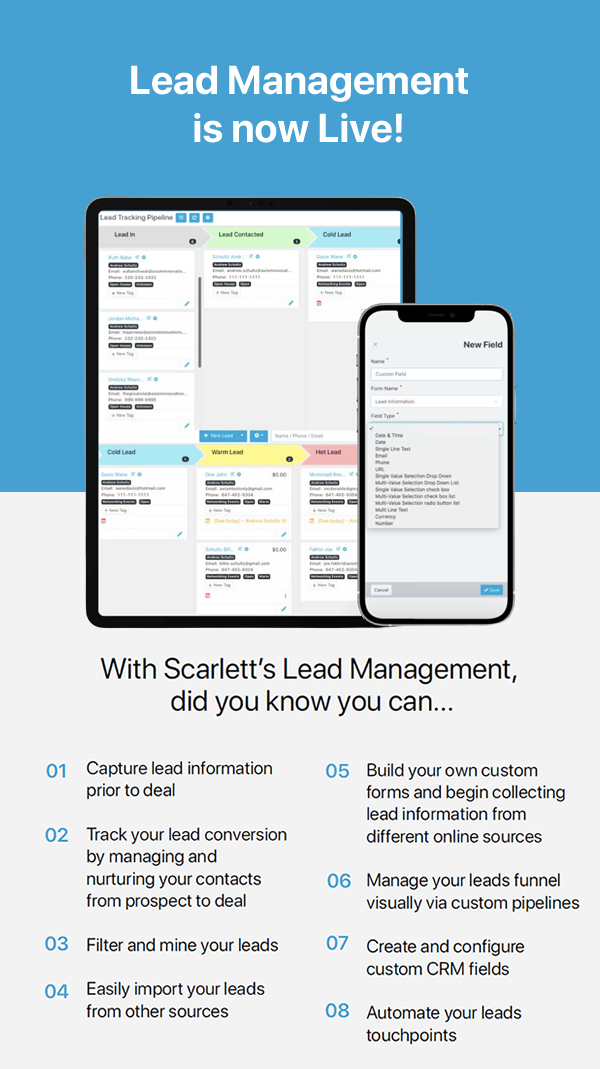

Scarlett’s Lead Management Integration continues to help brokers and agents quickly and efficiently grow their businesses. Scarlett continues to establish its status as the leading “one-stop shop” for brokers, brokerages and networks.

Scarlett’s priority has always been to allow every aspect of the mortgage transaction to be seamlessly managed in a single platform. Lead Management is another significant step in achieving that goal.

Joe Fakhri, Axiom’s president and chief executive officer, told Canadian Mortgage Professional that the move reflects the company’s tagline – “Don’t let your business run you, run your business” – adding even more automation into the mortgage process. “Scarlett is a one-stop shop,” he said.

“That’s the concept behind it: everything a mortgage broker requires to do their day-to-day business within one platform. That is what we’re aiming for.”

Integrating the lead management module into Scarlett’s Lead Management automation means that lead information can be managed and tracked before it becomes an actual live deal, allowing users to generate leads from different online sources and manage them from start to finish: from lead generation, to lead nurturing, all the way through to converting to an application. “It’s the funnel side of the transaction – getting a lead and nurturing it to full closure,” Fakhri explained. “This is what we set out to do, and this is exactly what we’ve built within the system.”

Integration between CRM and origination system

What’s different about Axiom’s approach to its platform, according to its business development manager Andrew Schultz, is the ability it provides for agents to customize and define their unique business management and workflow structures programmatically.

“We’ve taken that same approach with the lead management portion of the platform as we did with the mortgage origination side of the platform, Schultz said. ‘What are the real-life challenges of using a traditional CRM and integrating that with your origination system?

How do these two systems talk to each other? How do we cut out some of the double data entry, the inconvenience of managing multiple systems?”

He went on to say, “Effectively, what’s happened now is your lead management system lives within Scarlett Mortgage [formerly known as Deal Origination System]. And it will do things that are specific to a transaction that a mortgage broker needs to take on.”

Such functionality means that co-applicants or mortgage requests can now be tied into a lead’s profile, with the ability to track a whole series of information that will eventually become a part of the applicant’s profile. That’s a significant departure from the past, when agents had to take information from a lead and send them a mortgage application for completion only when they were finally ready to become applicants.

With Scarlett’s lead management automation, when a lead is converted into a deal, it travels from the lead management side of the system and creates the deal within the origination side that’s already prepopulated from the information previously captured. “The amount of time savings for an agent, and the added value that gets presented to the client, is incredible,” Schultz said. The client then only needs to review the information that has been automatically populated, adding any details that have changed about their current situation between becoming a lead and a mortgage applicant.

“It has taken the business purpose that a mortgage broker used as a CRM in conjunction with origination and houses it all under one roof,” Schultz said.

A winning solution

The module is “extremely customizable” for agents and brokers, and they can make it do what they want it to,” Fakhri said. “Lead Management provides tools that allow them to manage leads effectively – capturing leads through any lead generation tool out there, building pipelines, filtering data and drawing reports to mine leads and convert them into a deal.”

“Our lead management module is also bolted onto what the company calls an automation engine, allowing agents to automate specific tasks in their system, such as generating a thank-you email or a notification letting clients know they’ve been qualified. “We have taken some of the best features of the origination side of our platform, like the ability to mine and filter broker and agent data, and build dynamic, highly customizable pipelines and workflows, so they automatically update as you work through the file,” said Schultz.

“Users also can automate their communication, whether it be to the client or a task to the agent themselves. All of the user experience functions that allow people to work more efficiently on the deal now support the lead side of the business as well. Ultimately, the integration of the lead management tool into Scarlett represents a winning solution for mortgage professionals”, Fakhri said, “allowing them to run and manage their business with as high a degree of automation and flexibility as possible.”

“You’ve got all of the data elements at the core,” he said, “and the data capture process that’s very customizable and flexible for an agent and a broker. Around that, you’ve got a series of tools that will allow the agent to run their lead management process very effectively and seamlessly, with a high degree of automation.”

We are excited to announce Andrew Schultz’s promotion to VP of Sales. Before this new title, Andrew was the Business Development manager primarily focused on Axiom’s Scarlett Network SaaS product. Since Andrew joined Axiom Innovations in April 2019, he has proved to be instrumental in supporting Scarlett’s exponential growth. On behalf of the entire Axiom Innovations and Scarlett Network teams, please join us in congratulating Andrew for a well-deserved promotion.

Sarah is a dedicated and knowledgeable mortgage broker with nearly a decade of experience in all levels of residential underwriting on both the lender and broker side of the transaction. With a passion for education and system creation, Sarah is an advocate for the success of mortgage agents and is driven to make it easier for those around her to excel. Appreciated for her integrity, drive, and authenticity, Sarah has an established reputation within the mortgage industry. Her collaborative approach with her clients ensures an effective, productive, and long-lasting partnership.

SCARLETT is proud to have been an industry sponsor, speaker panel guest and trade-show attendee across Canada this year! From Halifax to Vancouver, we have had the opportunity to meet with brokers face-to-face to share the latest technology for the broker and lender channels in our industry.

We have launched our new “Powered by Scarlett” branding at the events, across social media channels, and with CMP and Mortgage Pros Canada coverage. We have met with our current broker, agent and lender clients and shared our technology with industry prospects.

Scarlett continues to evolve and lead the way regarding origination software. In this current mortgage landscape, efficiency and accurate execution is key to success so remember, “Don’t Let Your Business Run You…Run Your Business!”

FOR IMMEDIATE RELEASE – Friday, November 25, 2022

Newton Connectivity Systems and Axiom Innovations are pleased to announce the completion of not one but two major connectivity initiatives between Newton Connectivity Systems (Newton) and Axiom, effective today.

The first enhancement allows mortgage brokers and agents working on Axiom’s Scarlett Mortgage platform to connect directly to all Lenders accessing Newton’s connectivity bridges.

“Enhancing our connectivity in addition to adding true redundancy within Scarlett was a key driver for Axiom. Newton was a natural partner for Axiom and its Scarlett platform. Newton continues to invest in advancing its connectivity to lenders; hence providing our customers access to such enhancements was

a no-brainer.” – Joe Fakhri – President Axiom Innovations

“The Axiom team has cultivated a committed Scarlett customer base. We believe their audience can benefit from Newton’s two-way connectivity with lenders for both application data and direct documents transfer.” – Geoff Willis – President & CEO, Newton Connectivity Systems

Newton and Axiom are aligned in the belief that our industry is in critical need of enhancing the system-to-system interactions between mortgage client, broker/agent, and lender to eliminate both friction and time to complete a mortgage transaction. We believe that collaboration is key in achieving this.

“Connecting Scarlett Pay to Velocity was a must to further simplify, streamline and automate the payroll process for customers utilizing Velocity as their primary operating system. This enhanced integration makes life easier for our payroll customers and reduces the friction within their admin teams as they support multiple operating platforms. Further to the above, the added benefit for Axiom is to further expand its customer base for Scarlett Payroll since Newton’s Velocity has one of the largest user base of the industry.” – Joe Fakhri

“We felt that Velocity brokerages deserve seamless compliance and payroll integrations to assist them in running their operations. It was an easy decision to integrate with Axiom’s Payroll solution as a dominant provider in our space. Reducing friction and eliminating manual data entry is always worth pursuing and is often best achieved via collaboration with best-in-class providers.” – Geoff Willis

Both Velocity and Scarlett customers can benefit immediately from these enhancements.

For more information, please connect with:

Geoff Willis – President & CEO, Newton Connectivity Systems geoff.willis@newton.ca 604-657-9195

Joe Fakhri -President, Axiom Innovations joe.fakhri@axiominnovations.com 416-837-2297

We are excited to announce that the rebranding and upgrade to Broker-in-a-Box will be officially completed and available to all VERICO agents on January 31, 2023.

With the new Broker-in-a-Box upgrade VERICO brokers and agents can take advantage of the following new features:

The upgrade to Broker-in-a-Box means that some systems previously available will ONLY be available within the Deal Origination System.

Existing BrokerBasePlus brokers and agents should be aware that legacy tools will no longer be available and supported as of January 31, 2023. Legacy systems include:

Scarlett DOS has reached another new milestone! As we continue to build momentum and grow our user base, we are thrilled to see client engagement and usage accelerate.

As of the end of the First Quarter of 2021, our Broker/Agent clients have input over $5 Billion Dollars’ worth of applications into the DOS platform and we see no signs of it slowing down. With DOS’s automated systems and tools, it is easier than ever to provide your clients with customized electronic applications, e-sign capability, automated electronic document collection/authorization for CRA information, bank statements and much more. DOS also integrates easily with your current CRM eliminating the need for using multiple platforms. There isn’t a better tool in the market for managing your deal flow, with customized pipelines that include simple drag and drop as well as sharing features. Those are just a few highlights of what DOS has to offer. To discover more about Scarlett DOS’s great features and why the industry is so engaged, register for one of our online weekly demos, Monday, Wednesday and Friday, 2:00pm to 3:00pm EST.

Register here! https://zoom.us/meeting/register/tJUudOugqz4oHtNew03JfDevt1DusMTyaZ57

#mortgageproscanada #mortgagepro #mortgagebrokers #mortgagebroker #centum #rma #CIMBC #verico #mortgagesoftware #mortgagelenders #mortgageapplication #lenders #MonsterMortgage #AxiomMortgageSolutions #RealMortgageAssociates #CapitalLendingNetwork #OrianaFinancial #CLCNetwork”

On April 06, 2021 usership reached 5209 users / agents. It is very exciting times for us here at Axiom Innovations. This would not happen if it wasn’t for all our broker and lender clients.

#mortgageproscanada #mortgagepro #mortgagebrokers #mortgagebroker #monstermortgage #centum #rma #CIMBC #verico #mortgagesoftware #mortgagelenders #mortgageapplication #lenders #centum #MonsterMortgage #AxiomMortgageSolutions #RMA #RealMortgageAssociates #CapitalLendingNetwork #OrianaFinancial #CLCNetwork

SCARLETT PAYROLL & COMPLIANCE IS FEATURE PACKED AND BUILT TO SAVE YOU TIME AND MONEY BY HELPING YOU MANAGE YOUR BUSINESS MORE EFFICIENTLY!

Some of the features include:

Contact us today to learn more! Remember, stop letting your business run you and run your business!

Create Your Own Custom Pipelines and manage your deal flow the way you want….with as many pipelines as you want…as well as share them…

Full release notes are available via this link:

https://mailchi.mp/scarlettnetwork/welcome-to-the-future-of-mortgage-origination-5041378