Register here to attend one of our two

“REVUP YOUR REAL ESTATE REFERRALS” live sessions!

May 7th 10-11am

May 9th 2:30-3:30pm

Register here to attend one of our two

“REVUP YOUR REAL ESTATE REFERRALS” live sessions!

May 7th 10-11am

May 9th 2:30-3:30pm

Register here to attend one of the four “REFUEL YOUR RENEWAL PIPELINE!” live sessions!

March 26th 12-1pm

March 28th 12-1pm

April 2nd 3-4pm

April 4th 1-2pm

Register here to attend one of the two “REFUEL YOUR RENEWAL PIPELINE!” live sessions.

CLICK HERE TO REGISTER FOR OUR MORNING SESSION – March 12 @ 10 a.m.

CLICK HERE TO REGISTER FOR OUR AFTERNOON SESSION – MARCH 12 @ 3:30 p.m.

CMP ARTICLE

Dong Lee is embarking on a new adventure as the CEO of Axiom Innovations Inc. Lee brings a wealth of experience from his successful tenure at Mortgage Architects and DLC Group of Companies, now joining forces with longtime friend and Axiom president, Joseph Fakhri. With Lee’s expertise in sales and operations, coupled with Fakhri’s strength in product development and technology, the opportunities for growth at Axiom and Scarlett are immense.

Lee’s approach to his new role involves understanding the business and its culture before making any major changes. He’s excited to steer Axiom in the right direction and sees enormous potential in expanding strategic relationships and growing core products like Scarlett Mortgage and Scarlett Pay within the broker channel. Stay tuned for exciting developments as Lee leads Axiom into its next chapter!

#AxiomInnovations #NewCEO #BusinessGrowth #Partnership #LeadershipJourney

Scarlett came away with the Best Product or Innovation Award at this year’s Mortgage Awards of Excellence, an honour that founder and CEO Joe Fakhri (pictured top, right) described as an affirmation of its constant commitment to driving the mortgage process forward through technology.

“We’re happy and very proud of what the team has done – the fact that everybody has come together to rally around a common vision,” he told Canadian Mortgage Professional. “What it means is that all the innovation that we’ve put into the ease of use, speed of the system, and efficiency that it introduces to the mortgage space is paying off.”

Joe and Andrew recently spoke with CMPTV about technology in the mortgage space and how it contributes to the accuracy and efficiency of a brokerage’s processes. Scarlett continues to evolve as the mortgage landscape continually changes to allow for brokerages, brokers and agents (and lenders) to do what they do best…close deals and provide mortgage solutions. Click the link below to Watch the full video interview!

HOW CAN TECHNOLOGY CONTRIBUTE TO PERFECTING A BROKERAGE’S PROCESS?

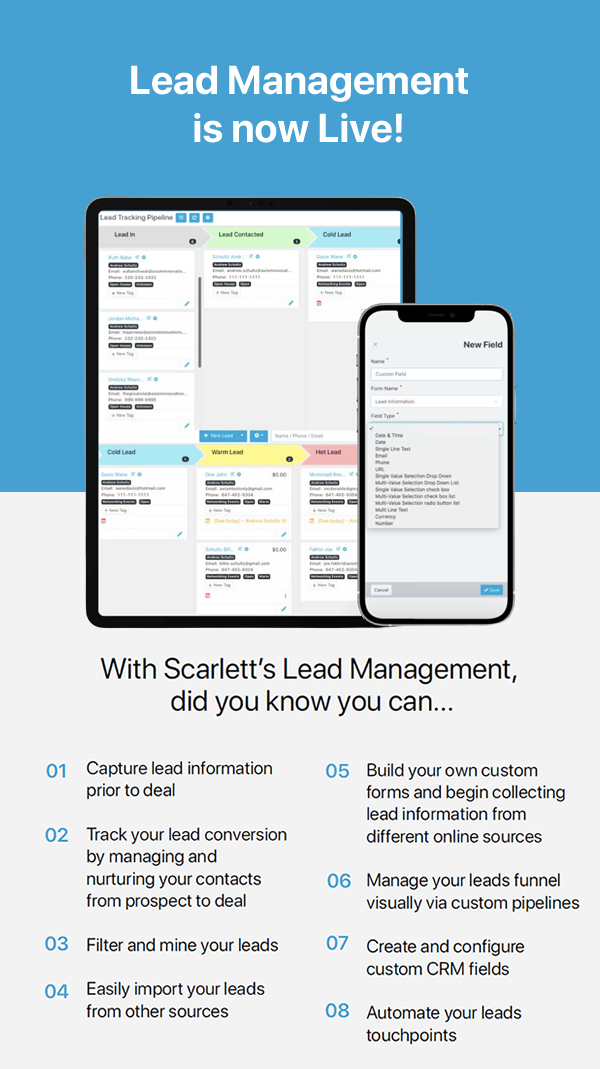

Scarlett’s Lead Management Integration continues to help brokers and agents quickly and efficiently grow their businesses. Scarlett continues to establish its status as the leading “one-stop shop” for brokers, brokerages and networks.

Scarlett’s priority has always been to allow every aspect of the mortgage transaction to be seamlessly managed in a single platform. Lead Management is another significant step in achieving that goal.

Joe Fakhri, Axiom’s president and chief executive officer, told Canadian Mortgage Professional that the move reflects the company’s tagline – “Don’t let your business run you, run your business” – adding even more automation into the mortgage process. “Scarlett is a one-stop shop,” he said.

“That’s the concept behind it: everything a mortgage broker requires to do their day-to-day business within one platform. That is what we’re aiming for.”

Integrating the lead management module into Scarlett’s Lead Management automation means that lead information can be managed and tracked before it becomes an actual live deal, allowing users to generate leads from different online sources and manage them from start to finish: from lead generation, to lead nurturing, all the way through to converting to an application. “It’s the funnel side of the transaction – getting a lead and nurturing it to full closure,” Fakhri explained. “This is what we set out to do, and this is exactly what we’ve built within the system.”

Integration between CRM and origination system

What’s different about Axiom’s approach to its platform, according to its business development manager Andrew Schultz, is the ability it provides for agents to customize and define their unique business management and workflow structures programmatically.

“We’ve taken that same approach with the lead management portion of the platform as we did with the mortgage origination side of the platform, Schultz said. ‘What are the real-life challenges of using a traditional CRM and integrating that with your origination system?

How do these two systems talk to each other? How do we cut out some of the double data entry, the inconvenience of managing multiple systems?”

He went on to say, “Effectively, what’s happened now is your lead management system lives within Scarlett Mortgage [formerly known as Deal Origination System]. And it will do things that are specific to a transaction that a mortgage broker needs to take on.”

Such functionality means that co-applicants or mortgage requests can now be tied into a lead’s profile, with the ability to track a whole series of information that will eventually become a part of the applicant’s profile. That’s a significant departure from the past, when agents had to take information from a lead and send them a mortgage application for completion only when they were finally ready to become applicants.

With Scarlett’s lead management automation, when a lead is converted into a deal, it travels from the lead management side of the system and creates the deal within the origination side that’s already prepopulated from the information previously captured. “The amount of time savings for an agent, and the added value that gets presented to the client, is incredible,” Schultz said. The client then only needs to review the information that has been automatically populated, adding any details that have changed about their current situation between becoming a lead and a mortgage applicant.

“It has taken the business purpose that a mortgage broker used as a CRM in conjunction with origination and houses it all under one roof,” Schultz said.

A winning solution

The module is “extremely customizable” for agents and brokers, and they can make it do what they want it to,” Fakhri said. “Lead Management provides tools that allow them to manage leads effectively – capturing leads through any lead generation tool out there, building pipelines, filtering data and drawing reports to mine leads and convert them into a deal.”

“Our lead management module is also bolted onto what the company calls an automation engine, allowing agents to automate specific tasks in their system, such as generating a thank-you email or a notification letting clients know they’ve been qualified. “We have taken some of the best features of the origination side of our platform, like the ability to mine and filter broker and agent data, and build dynamic, highly customizable pipelines and workflows, so they automatically update as you work through the file,” said Schultz.

“Users also can automate their communication, whether it be to the client or a task to the agent themselves. All of the user experience functions that allow people to work more efficiently on the deal now support the lead side of the business as well. Ultimately, the integration of the lead management tool into Scarlett represents a winning solution for mortgage professionals”, Fakhri said, “allowing them to run and manage their business with as high a degree of automation and flexibility as possible.”

“You’ve got all of the data elements at the core,” he said, “and the data capture process that’s very customizable and flexible for an agent and a broker. Around that, you’ve got a series of tools that will allow the agent to run their lead management process very effectively and seamlessly, with a high degree of automation.”

We are excited to announce Andrew Schultz’s promotion to VP of Sales. Before this new title, Andrew was the Business Development manager primarily focused on Axiom’s Scarlett Network SaaS product. Since Andrew joined Axiom Innovations in April 2019, he has proved to be instrumental in supporting Scarlett’s exponential growth. On behalf of the entire Axiom Innovations and Scarlett Network teams, please join us in congratulating Andrew for a well-deserved promotion.

Sarah is a dedicated and knowledgeable mortgage broker with nearly a decade of experience in all levels of residential underwriting on both the lender and broker side of the transaction. With a passion for education and system creation, Sarah is an advocate for the success of mortgage agents and is driven to make it easier for those around her to excel. Appreciated for her integrity, drive, and authenticity, Sarah has an established reputation within the mortgage industry. Her collaborative approach with her clients ensures an effective, productive, and long-lasting partnership.

SCARLETT is proud to have been an industry sponsor, speaker panel guest and trade-show attendee across Canada this year! From Halifax to Vancouver, we have had the opportunity to meet with brokers face-to-face to share the latest technology for the broker and lender channels in our industry.

We have launched our new “Powered by Scarlett” branding at the events, across social media channels, and with CMP and Mortgage Pros Canada coverage. We have met with our current broker, agent and lender clients and shared our technology with industry prospects.

Scarlett continues to evolve and lead the way regarding origination software. In this current mortgage landscape, efficiency and accurate execution is key to success so remember, “Don’t Let Your Business Run You…Run Your Business!”

FOR IMMEDIATE RELEASE – Friday, November 25, 2022

Newton Connectivity Systems and Axiom Innovations are pleased to announce the completion of not one but two major connectivity initiatives between Newton Connectivity Systems (Newton) and Axiom, effective today.

The first enhancement allows mortgage brokers and agents working on Axiom’s Scarlett Mortgage platform to connect directly to all Lenders accessing Newton’s connectivity bridges.

“Enhancing our connectivity in addition to adding true redundancy within Scarlett was a key driver for Axiom. Newton was a natural partner for Axiom and its Scarlett platform. Newton continues to invest in advancing its connectivity to lenders; hence providing our customers access to such enhancements was

a no-brainer.” – Joe Fakhri – President Axiom Innovations

“The Axiom team has cultivated a committed Scarlett customer base. We believe their audience can benefit from Newton’s two-way connectivity with lenders for both application data and direct documents transfer.” – Geoff Willis – President & CEO, Newton Connectivity Systems

Newton and Axiom are aligned in the belief that our industry is in critical need of enhancing the system-to-system interactions between mortgage client, broker/agent, and lender to eliminate both friction and time to complete a mortgage transaction. We believe that collaboration is key in achieving this.

“Connecting Scarlett Pay to Velocity was a must to further simplify, streamline and automate the payroll process for customers utilizing Velocity as their primary operating system. This enhanced integration makes life easier for our payroll customers and reduces the friction within their admin teams as they support multiple operating platforms. Further to the above, the added benefit for Axiom is to further expand its customer base for Scarlett Payroll since Newton’s Velocity has one of the largest user base of the industry.” – Joe Fakhri

“We felt that Velocity brokerages deserve seamless compliance and payroll integrations to assist them in running their operations. It was an easy decision to integrate with Axiom’s Payroll solution as a dominant provider in our space. Reducing friction and eliminating manual data entry is always worth pursuing and is often best achieved via collaboration with best-in-class providers.” – Geoff Willis

Both Velocity and Scarlett customers can benefit immediately from these enhancements.

For more information, please connect with:

Geoff Willis – President & CEO, Newton Connectivity Systems geoff.willis@newton.ca 604-657-9195

Joe Fakhri -President, Axiom Innovations joe.fakhri@axiominnovations.com 416-837-2297

We can’t think of a better reason to take a bit of a pause than to appreciate our planet. Tomorrow, take that deep, well-deserved breath and make a small contribution to our planet’s health. Take a minute to pick up a piece of litter, recycle something or turn off some appliances or some lights in your home or office…every little thing makes a difference.

#EarthDay2021 #mortgageproscanada #mortgagepro #mortgagebrokers #mortgagebroker #centum #rma #CIMBC #verico #mortgagesoftware #mortgagelenders #mortgageapplication #lenders #MonsterMortgage #AxiomMortgageSolutions #RealMortgageAssociates #CapitalLendingNetwork #OrianaFinancial #CLCNetwork

For Immediate Release to Canadian Mortgage Brokers.

Axiom Innovations is committed to providing the mortgage industry with the only independent fintech platform with access to all lenders.We are pleased to announce that effective immediately, your ability to submit deals to Scotiabank is available via the Deal Origination System.

Thank you to the teams at Scotiabank and Filogix for enabling us to test and validate the integrity of our connection and data leading up to integration and launch.

Should you have any questions you can reach us via the following:

Andrew Schultz – andrew.schultz@scarlettnetwork.com – 647.402.9304

David Young – david.young@scarlettnetwork.com – 902.818.5500

https://www.scarlettnetwork.com – Support Hotline – 1.855.561.4399 / Press 2

For Immediate Release to Canadian Mortgage Brokers.

Axiom Innovations is committed to providing the mortgage industry with the only independent fintech platform with access to all lenders. We are pleased to announce that beginning on July 17, 2020, our platform will give you the ability to submit mortgage deals to Scotiabank.

Thank you to the teams at Scotiabank and Filogix for enabling us to test and validate the integrity of our connection and data leading up to integration and launch later this week. From the 17th forward you will find Scotiabank listed in the Lender drop-down menu on DOS.

Should you have any questions you can reach us via the following:

Andrew Schultz – andrew.schultz@scarlettnetwork.com – 647.402.9304

David Young – david.young@scarlettnetwork.com – 902.818.5500

https://www.scarlettnetwork.com – Support Hotline – 1.855.561.4399 / Press 2

#mortgage_origination #payroll #compliance #crm #websites

#mortgagebrokers #mortgagelenders #technology #scarlett

#pointofsale #mortgage_applications #pointofsale #directtolender

Filogix is excited to announce that Axiom Innovations is now part of the Filogix Mortgage Marketplace. Axiom is a business automation, process engineering and software solutions company that provides Deal Origination Solutions (DOS) to brokers, allowing them to manage their mortgage deals anywhere, anytime, from any device. Brokers using Axiom’s new DOS platform can now submit mortgage deals directly to the Filogix lender network. To learn more about Axiom’s DOS, click here.

Source: https://www.filogix.com/releases/axiom-innovations-is-now-a-filogix-marketplace-partner/

No marketing tool is quite as overlooked as the email signature. It’s more than just a time-saving solution for day-to-day email communications; your signature is a powerful marketing device that allows you to convey professionalism and elevate brand recognition. For mortgage companies, having a uniform email signature is especially important. Keep reading to learn more about the benefits and importance of an email signature.

With every email that your employees send, they are representing the business to current and future clients. Naturally, you want to put the best foot forward with all of your communication efforts. With a written letter, you would likely use company letterhead with your business name and logo on it to exhibit your legitimacy. Your email correspondence shouldn’t be any different. With a well-designed signature, you can achieve the same effect, letting everyone know that your company is professional and trustworthy.

Your email signature can also be used as a helpful resource to readers. You can place links in the signature that direct people to important pages. For example, you could put a link to your website, email address, or social media page. This makes it easier for your clients to find you online and reach significant sites when they need to.

Signatures also play a crucial role in your online marketing plan. They are like a digital version of your business card; they provide valuable contact and other information to customers in a convenient manner. Ideally, the signature should contain all of the information a client needs to contact your lender and your company again. This makes it simple for new and returning customers to reach you when they need to. This, in turn, increases sales and helps you to close more deals.

Brand recognition is a vital part of good marketing. Your email signature is a useful tool in the process of increasing brand recognition, especially when you add your logo. By including your logo in the signature, your clients will begin to associate your business and the good work you provide with the image. The more people see your logo, the greater your brand recognition will be. This results in better trustworthiness, more sales, and happier customers. Talk to the company that provides your mortgage broker software to learn how to add a logo to your email signature.

According to the SAFE Act, every mortgage loan officer must offer their NMLS ID number in their initial communication with a client. This is true for written and electronic communications. In many states, you must also display your ID number on advertisements and other marketing materials, including emails. By adding this information to your email signature, you can ensure compliance with the SAFE Act without even thinking about it.

You can also put legal, confidentiality, and privacy disclaimers in your email signature. When they are worded correctly, these can protect your company and clients from legal trouble down the road. Plus, it is simple and convenient for your business.

Contact us at Scarlett to learn more about our mortgage broker management software.

Customer relationship management software offers many advantages to businesses. These programs allow businesses to manage their relationships with their customers by tracking and accessing data and information. Mortgage brokers can use the knowledge obtained with the use of CRM software to increase their sales. Here are a few ways that mortgage brokers can increase sales with CRM software.

One of the major advantages of CRM software is that it allows companies to store all of their data in a single, unified database. Any employees that might need this information can easily access it through the database. If a customer contacts the company, whoever is speaking with them needs to know their history with the company. Clients don’t want to have to repeat information they’ve already discussed as this might make it seem as though they’re taking steps back. Any employee that speaks with the client will have all of their histories with the business in front of them.

Businesses are constantly looking for new and innovative ways to market their company and attract leads. It can be difficult to tell which of these strategies works best. CRM software allows businesses to create a number of marketing strategies and provides data so that you can discover which one works best. This will ensure that you’re doing everything you can to attract leads to your business. The data collected will also allow your business to determine the most cost-effective way of marketing your business, ensuring that you’re not wasting any money.

While capturing leads is an important asset for a company, knowing which of these leads may be converted is just as important. CRM software can help with both of these tasks. Potential leads will be captured through web traffic and inquiries. Once the leads have been captured, they’ll be ranked based on those that are most sales ready to least sales-ready. This will allow you to determine which leads are ready to be sent to your sales team. The result is that your sales team will be focusing on the most promising leads, leading to more profitability.

Capturing and maintaining customer information can be a time-consuming process. CRM software captures this information and then keeps it stored so that it can be easily accessed by anyone that needs it. This software allows you to scan business cards and will automatically catalog them. Any emails sent or received to or from a client will be automatically stored in customer profiles. If the sales team or anyone else speak with a current or prospective client, they can immediately access this information. This will ensure that you keep your conversations moving forward as opposed to repeating information, leading to more sales.

Whenever you come into contact with a customer, there is a sales process that you go through. CRM software will track this process from each interaction you have with a customer. This will allow anyone that speaks with them to know how close they are to the sale. The result is that you can continue taking positive steps with the client until the sale is complete without any duplicated steps or missteps.

CRM software allows you to capture and maintain various data on your current and prospective clients. This will allow you to efficiently complete sales. Contact Scarlett if you’re in need of a mortgage broker CRM.

Managing customer relationship and your firm can be challenging. If you’re using a general purpose customer relationship management platform or spreadsheets, you’re probably running in circles or not reaching your businesses full potential.

To help grow your business and streamline your firm, mortgage CRM software can help you. But how do you know what to choose?

Whether you are a large office full of brokers or an individual just getting stated, your CRM software should include a few main items. The mortgage broker CRM software should be intuitive and powerful, easy to implement, be a reasonable price, keep customers and contacts organized, be an out of the box solution using modern automation to handle marketing and lead management, be customizable to your business, and be cloud-based for easy access. Your most important aspect to look for in your mortgage CRM is the software should help you grow your business.

The mortgage industry is a relationship industry at its core. Your CRM platform should help you deliver the customer service your clients have come to expect. Some traits to look out for that can assist with this relationship building include deal flow management, business intelligence and reporting, client document porta, email, contact and task synchronization, automatic digital communication, and tasks management. These types of items can help keep your team on track and keep the lines of communication between you and your client open.

A mortgage broker CRM can help you execute your marketing campaigns an grow your business. Create a website, include state of the art mortgage calculator, application capture, search engine optimization modules, integrate your social media, and leverage a content management interface all in one place. Marketing is a vital part of your business, and many do not have the time to commit or the means to outsource. Utilizing a CRM that simplifies your strategy can set you apart from your competition.

Many CRM software’s offer a variety of different features. Some important items that other platforms may not offer include payroll and commissions processing, loan and deal origination, and point of sale integration.

Streamlining and growing your business can be simplified through use of a mortgage broker CRM. Through building relationships with automated emails to marketing on your social media platforms, a CRM can give you the relief you need to find more business or handle more. To learn more about what the pros say you should consider before choosing a CRM, visit Scarlett at https://www.scarlettnetwork.com/.

Do you have a mortgage broker marketing plan? If not, you’re not making as much money as you should be. You need a way to reach your customer base and you need a way to educate them about mortgages. Many mortgage brokers make the assumption that consumers need them and, therefore, don’t need to actively market. However, this way of thinking is old school, and it’s limiting your reach. Keep reading to learn more about tools and strategies for mortgage broker marketing.

Social media is a broker’s best friend. It’s a way to reach thousands upon thousands of people without spending a fortune. Social media allows you to market to people actively looking for homes as well as those considering buying in the future. When used as a tool for your business, people are learning about your business and the industry. Posting once a day at minimum is ideal, but if you can post 2-3 times a day on different topics, you’ll stay in the consumer’s newsfeed longer.

The bottom line: Mortgage broker digital marketing is a must.

Old school mortgage brokers marketing tactics often included things such as mailing out postcards every few months or placing ads in local newspapers or other publications. Today’s broker needs to reach their customers in a different way. Many potential customers don’t check their mail often because they do a lot of their business online, and if they do check their mail, the chances are high they’ll throw that mailer away. They are literally throwing your money away.

The good news is there’s a better way to reach your customer base, and this is through automated email marketing. Create a landing page on your website for visitors to sign up for updates about new products and services. Then, send them a monthly email. Depending on open rates and links clicked, set up an automated email campaign to target your customers even more. Yes, some of those newsletters are going to end up in the trash folder, and you’ll get unsubscribes, but you’re not wasting hundreds or thousands of dollars on a campaign. Email automation can be free depending on the size of your list.

The best mortgage broker marketing goes against the norm. If you’re doing everything exactly as every other broker is doing it, your results will be average. Wouldn’t it be nice to achieve stellar results? Think outside of the box. How can you educate people about the mortgage industry and gain clients? Maybe you speak at networking events? Or, write an ebook about the mortgage industry and use it as a giveaway with your information scattered throughout the book. Brainstorm ideas that set you apart from the crowd.

As you build your business, remember that you’re building your brand. What do you want your brand to be associated with and how do you want to be seen? Mortgage brokers marketing is something you need to devote time and energy to, so your business grows. When you increase your digital presence, resist going with the flow, and use automation to engage, you become a force to be reckoned with, and rightly so.

Do you need help with marketing? Contact SCARLETT, your broker in a box marketing solution. Visit them online at https://www.scarlettnetwork.com to learn more about pricing and marketing services.

Any business that deals with customers one-on-one needs to understand who they are to provide quality service. Customer relationship management, commonly referred to as CRM, is a system that allows a company to input all data about a customer and record their interaction with that company into a program and share it with all departments within the company. This allows easier access to customer records to provide better and faster service. Here are a few reasons why a mortgage broker CRM is an essential tool.

When a customer interacts with a business, they want to feel important and valued. Tracking and recording interactions can make working with your customers more efficient and smooth. This can include any calls made to the customer, proposals that have been sent to the customer, any responses received from the customer, and a list of any services provided. You’ll be able to retain your clients by providing them with better service.

For any mortgage broker, prospecting for clients can take up a great deal of time. Customer relationship management software allows you to create a list of all prospects and put them in specific demographics. This makes recording and maintaining this information easier and more efficient. It also helps generate quality leads, which will reduce the amount of time spent on potential clients who end up going elsewhere. Efficiency is an essential part of a successful business, and customer relationship management software will allow you to increase your efficiency substantially.

As your company grows, you will gain more customers, which may make managing customer relationships more difficult. While your customers want personalized service, it can be difficult to develop a relationship with and focus attention on one particular customer. CRM software will allow you to manage customer relationships better because it provides necessary information about them.

The more you know about your customers, the more you’ll understand their needs and wants. While they may come to you looking for a specific solution, you may be able to help them with problems of which they’re unaware. This will allow you to attract more business from that existing customer while continuing to provide excellent service.

Efficiently managing customer relationships is an essential aspect of any successful mortgage broker. The implementation of mortgage broker CRM will allow your company to easily share information so that customers always feel as though they are moving forward with the process rather than repeating what has already been discussed. This will result in happier customers and more successful interactions. If you’re in need customer relationship management software for your business, contact Scarlett Network.

In today’s crowded field of mortgage brokers competing for the attention of homebuyers, it’s easy to blend into the field. But becoming a successful mortgage broker means developing a successful marketing strategy that can make you stand out from the crowd of other brokers all vying for the attention of homebuyers. Fortunately, there’s a wide variety of tools that can make the seemingly difficult task of mortgage broker marketing a simple and straightforward affair. For example, by harnessing the power of mortgage broker software, you can determine a target audience, formulate a strategy, utilize diverse marketing channels, and track your marketing spend.

Software can be a key mortgage broker solution that helps tackle a difficult but necessary task. If you’re floundering when it comes to marketing your business effectively, learn what it takes to distinguish yourself from your competitors, and bring all the available marketing channels to bear in support of your business goals. Don’t forget your creativity either, as marketing is about more than demographics and analytics. Read on to learn a few marketing tips that can help you step outside of the crowd of brokers in the market and get more business.

First, you need to determine who represents your target audience. In today’s mortgage field, most customers fall into one of two categories. Those two categories are new homebuyers and refinance customers. While both categories are in search of financing, their ends are very different, as are their concerns. For example, a typical refinance customer is well-versed in the mortgage game and is concerned with getting a low rate. As a result, those customers are more prone to shop around than new homebuyers. New homebuyers, on the other hand, are unfamiliar with the process. They may want to be counseled on mortgage matters and are looking for advice. They may be less prone to shop around, depending instead on referrals from friends, family, or real estate agents. Knowing this information can help you tailor your messaging and the way it’s delivered, so spend some time identifying your audience.

Social media represents one of the most dynamic forms of communication available to mortgage brokers today. It’s diverse in its application and the way messaging is delivered. Some social media platforms have built-in advertising capabilities and advanced analytics that can help you target your best audience directly. Make sure that you use social media to promote yourself in a controlled manner, and don’t be afraid to spend a little per month on social media advertising. The return-on-investment is one of the best buys in marketing.

Content marketing is another tool that any mortgage broker can use to get the attention of potential customers. Content marketing involves the creation and distribution of high-quality content that is of benefit to potential customers. The idea is that they search the internet for specific topics, and when they locate your content and appreciate the information offered, you create a digital lead or sales funnel. Content marketing will channel customers to your digital profile and help you become an authority in the field. The benefits are too great to ignore for mortgage brokers, so develop a blog and populate it with great content to see your business grow.

While it can be intimidating to the uninitiated, pay-per-click advertising can be a dynamic marketing tool for mortgage brokers. No matter which PPC provider you use, landing on the first page of search engine results is key. Stats indicate that it’s an important consideration in any industry, and with a sound PPC and SEO strategy, you can see your business grow exponentially. It pays to learn about PPC strategy, and bidding on keywords isn’t as difficult as it may seem.

If you’re looking to grow your business through marketing, utilize these tips to identify your audience and develop messaging to meet them through a variety of marketing channels. To learn more about marketing your brokering business, visit Scarlett at https://www.scarlettnetwork.com/.

A customer relationship management software program, or CRM, is a very useful tool for a variety of industries. This software allows you to easily manage a large volume of interactions with your clients and communicate with them effectively. As with many other industries, there are specific CRM programs designed for mortgage planners and others within the financial services industry to simplify running a business. Using one of these programs will allow you to manage your customer data, automate sales, track leads, support customers, and more. This software will make it much easier to handle a large number of transactions consistently and stay in touch with your clients for better overall service. Here are some things that you should consider before deciding on a mortgage broker software program for your business.

Let’s face it, you’re on the move all the time. Your job takes you somewhere new every day. Your phone IS your office, so it goes without saying, your CRM has to be mobile friendly.

In a time where instant gratification and communication is so desired, the capability of mobile support is more important than ever. Mobile functionality with your CRM will allow you to answer any questions or serve any request your customers may have regardless of where you might be. You will also be able to access your tasks, appointments, and customer contacts from anywhere so that you will always be prepared for anything you might have scheduled.

Are you tired of updating the same data in different places, when you could be focused on driving your business? In this digital age, there are a variety of systems that you likely already have set up for your business. It’s important that these systems can work together to avoid any confusion. If the CRM that you purchase can’t integrate with your other systems, this could cause a great deal of time and effort to allow these systems to work together as needed.

Purchasing a system with this capability will allow you to avoid multiple set-ups or installations that otherwise would be required. The ability to have your CRM easily integrate with your other systems will allow you to easily set up the system and ensure that you don’t suffer from any downtime that could cost you money.

Some important integration to consider: Expert, Equifax, Email platform, website, social media and e-signature.

Current and potential customers want to be able to easily interact with your company so anything that makes that easier is essential. A web portal will allow customers to post comments, make inquiries, file documents and retrieve other information with ease and without printing anything out. This will allow them to provide the information you need quickly so that you spend less time waiting on the customer.

The relationship with customers and handling a high volume of transactions are some of the most important aspects of a business. A mortgage CRM allows industry professionals to effectively communicate and serve their customers. Before purchasing a mortgage broker technology solution, ensure that the one you’re considering has these features. Contact Scarlett if you’re in the market for a mortgage CRM to assist your business.

Effective today; April 29, 2019; Andrew Schultz joins Axiom Innovations as its Business Development Manager representing the Scarlett suite of products.

Andrew was born into a family of real estate brokers, and was raised during the Toronto real estate boom; so it was natural that he find himself on a collision course with the industry. After graduating from Acadia University, where he studied Economics, Andrew started his professional career as a recruiter for North America’s largest IT staffing services firm. He excelled quickly, even earning several monthly award for productivity. During this time, he honed his relationship building/management skills, and was immersed in the world of enterprise technology.

From there, Andrew transitioned to the real estate industry, when he obtained his real estate license and joined his family’s multi-office brokerage. Increasingly, he absorbed management responsibilities, before transitioning full time to Director of Business Development and Technology.

With a mandate to attract and retain top talent in the real estate industry, Andrew’s primary objective was to realize an omni channel brokerage experience, through upgrades to the quality of the brokerage technology service offering.

Through these efforts, Andrew has planned and implemented several solutions with industry leading partners, in the the following areas:

His mix of technical and business experience on the client side is the key to Andrew’s success. This allows him to act as a strategic partner by truly understanding the unique goals, needs and challenges associated to the industries in which he works. Andrew believes that success in the world of technology starts with a great product. After that, you need business acumen/awareness, excellent communication, relationship building and execution.

He is excited to join the team at Axiom Innovations, because he believes their products and services are the industry leader, and align perfectly with his beliefs and values.

When Andrew is not at work, you can find Andrew on the golf course, at the curling rink, out for dinner with friends or digging through dusty old record crates!

Please join me in welcoming Andrew to the Axiom family. We are excited to have Andrew on-board as he brings a wealth of business knowledge from both the real estate and mortgage verticals. Andrew can be reached via his corporate email at andrew.schultz@axiominnovations.com

Joe Fakhri – President & CEO