The Most Common Broker Mistakes (and How to Avoid Them)

Success in the mortgage industry often comes down to the details. Small oversights can lead to missed opportunities, frustrated clients, or delayed closings. The good news? Most broker mistakes are easy to fix once you know what to watch for. In other words, a few smart changes can make a big difference.

Quick Summary: This post covers the five most common mortgage broker mistakes and how to avoid them through better communication, organization, and technology.

According to the Financial Consumer Agency of Canada, clear communication is a key driver of client confidence and satisfaction. Therefore, understanding where most brokers go wrong can help you strengthen relationships and improve your workflow.

Mistake 1: Poor Communication

Many brokers assume clients understand every step of the mortgage process. However, most borrowers need guidance and reassurance. Without consistent updates, clients can easily feel anxious, confused, or uninformed. As a result, your credibility may suffer even when you’re doing everything right behind the scenes.

How to Avoid It:

Set clear expectations early, and keep clients informed at every stage. For example, provide regular updates even when there’s no major news to share. A quick email or portal message through your CRM system can go a long way in keeping clients confident and engaged. In addition, take time to explain key steps so clients feel empowered, not overwhelmed.

Mistake 2: Disorganized Documentation

It’s easy to lose track of paperwork or miss key documents when you’re juggling multiple clients. Consequently, disorganization can slow down the process and damage your professional credibility. Moreover, it increases the risk of errors that could delay approvals.

How to Avoid It:

Use a secure digital document system to collect, store, and track files. In addition, set up automated reminders, audit trails, and smart checklists to ensure nothing slips through the cracks—and make compliance audits stress-free. As a result, you’ll look more professional and deliver a smoother client experience.

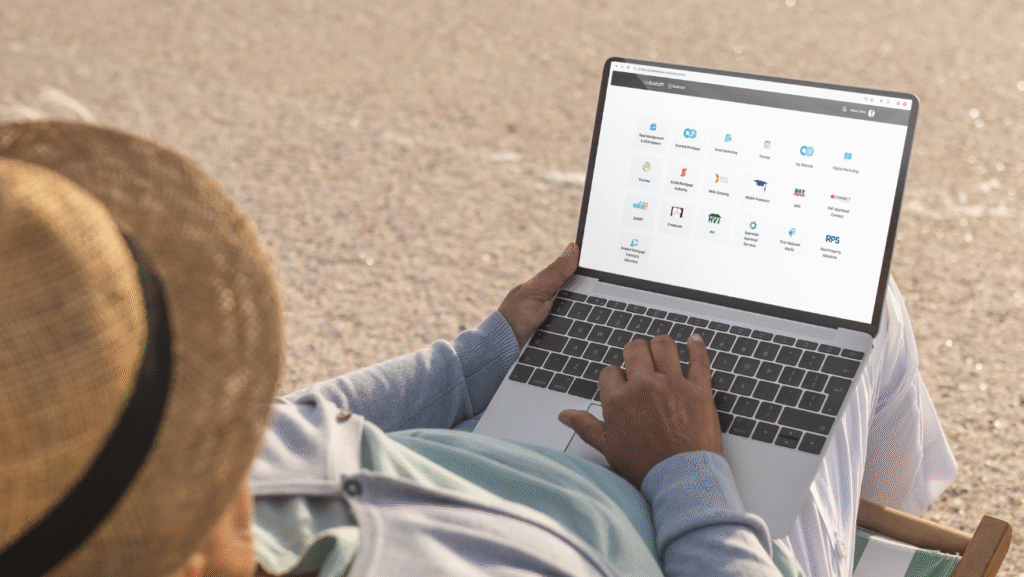

Mistake 3: Ignoring Technology

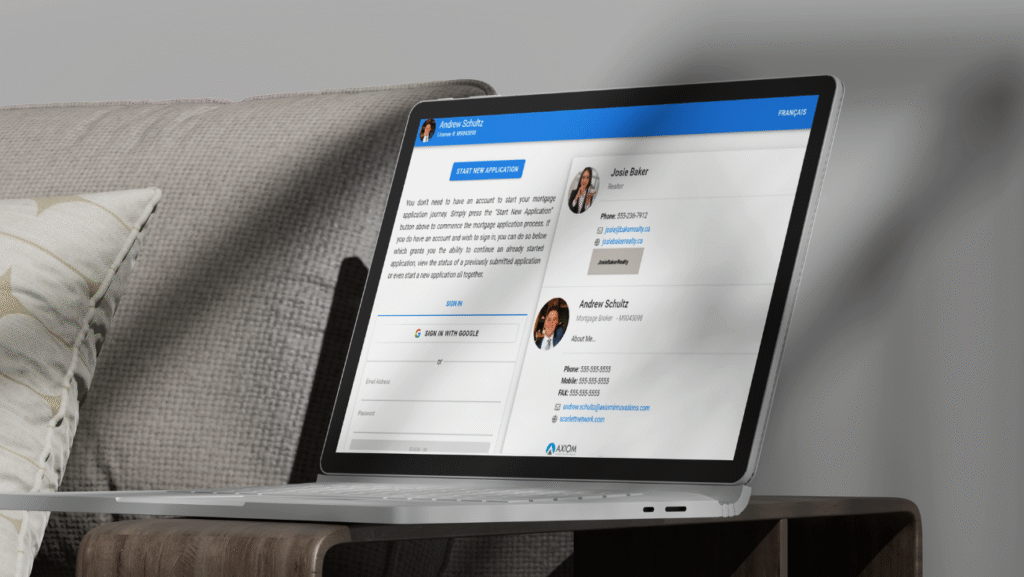

Some brokers still rely heavily on manual processes, which limits both efficiency and scalability. Over time, this can lead to unnecessary delays and inconsistent service. Furthermore, it makes it harder to handle growing client volumes without burnout.

How to Avoid It:

Embrace mortgage technology that streamlines your workflow. Tools like digital mortgage platforms, CRMs, and e-signature solutions save hours of repetitive work while improving accuracy and client satisfaction. To sum up, technology doesn’t replace your expertise—it amplifies it. As a result, you can focus more on relationships and less on repetitive admin work.

Mistake 4: Overlooking Compliance

Regulations are constantly evolving. However, failing to stay current can result in penalties, lost trust, or even legal consequences. For that reason, compliance should never be an afterthought. In contrast, brokers who make compliance part of their workflow build lasting client confidence.

How to Avoid It:

Make compliance part of your daily routine. Use software with built-in FINTRAC checks, ID verification, and automated regulatory updates to stay aligned with the latest standards. Therefore, you’ll reduce risk while protecting both your reputation and your clients’ trust.

Mistake 5: Neglecting Follow-Up

After closing, many brokers move straight to the next file—missing a golden opportunity to strengthen relationships and earn referrals. As a result, they lose valuable repeat business. However, with a structured follow-up plan, you can stay connected and keep your client base growing.

How to Avoid It:

Create a post-closing follow-up plan for every client. For instance, send a thank-you message, check in after move-in, and schedule renewal reminders. Consistent engagement keeps your name top-of-mind when clients refer friends or return for future mortgages. In conclusion, a little effort after closing can lead to significant long-term gains.

Final Thoughts

Avoiding these common mortgage broker mistakes isn’t about working harder—it’s about working smarter. Ultimately, clear communication, organized systems, and the right technology will help you create a smoother client experience and a stronger foundation for long-term success.

Keywords: mortgage broker mistakes, mortgage technology, broker compliance, client communication, Scarlett Network, Scarlett CRM, FINTRAC, broker efficiency, digital mortgage platforms, mortgage workflow tools