Mortgage broker priorities in 2026 are shifting quickly across Canada as market conditions continue to tighten.

Brokers are managing rising compliance expectations while margins remain under pressure.

At the same time, borrowers expect faster answers and clearer communication throughout the process.

Because of this, the way brokerages operate today has a direct impact on growth.

The mistakes costing mortgage brokers growth in 2026 are rarely dramatic or sudden.

Instead, they tend to develop through inefficient workflows, disconnected systems,

and compliance processes that slow teams down rather than support them.

Over time, these operational gaps compound and quietly erode profitability.

At Scarlett Network, we work closely with brokerages across Canada every day.

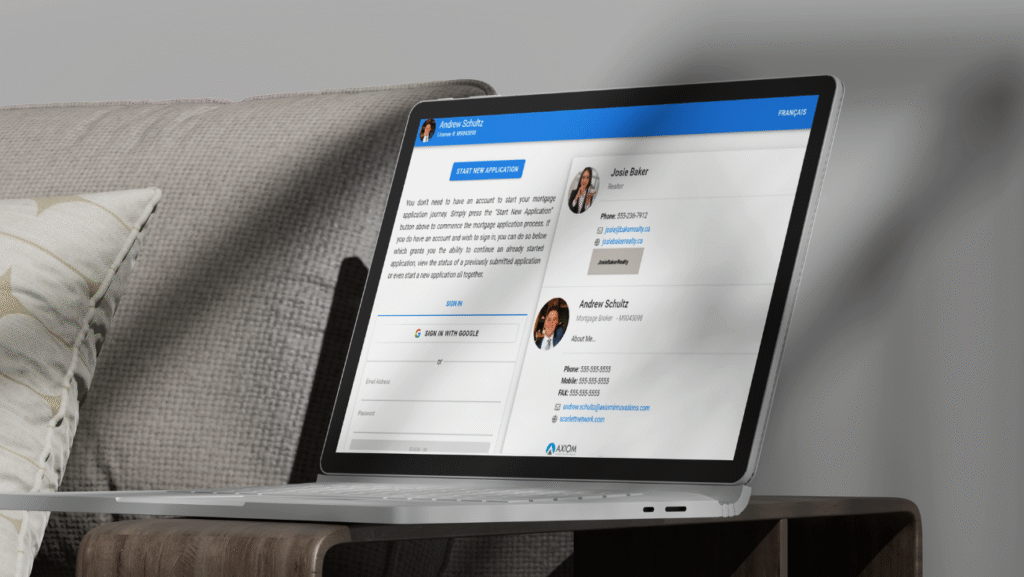

Our mortgage broker operations platform helps teams simplify compliance,

streamline onboarding, and manage day-to-day workflows more effectively.

As a result, the most successful brokerages share one common approach:

they invest in strong operational foundations that support growth, compliance, and client trust.

Borrowers Expect Transparency, Speed, and Consistent Communication

Mortgage borrowers in 2026 are more informed and more cautious than ever before.

They expect clear explanations, realistic timelines,

and consistent communication throughout the mortgage process.

When these expectations are not met, confidence declines quickly.

- Clear next steps at every stage of the file

- Consistent updates as applications progress

- Fewer last-minute surprises or delays

When communication breaks down or expectations are not set early,

trust erodes and referrals suffer.

However, strong internal systems allow brokers to educate clients sooner,

set expectations clearly, and maintain confidence from application to closing.

Compliance Has Become a Daily Operational Requirement

Regulatory expectations continue to increase across the mortgage industry,

which means compliance can no longer operate as a back-office function.

Brokerages that rely on manual tracking or fragmented documentation

often feel this strain most as volume fluctuates.

Guidance from

the Financial Consumer Agency of Canada

underscores the importance of consistent documentation,

agent oversight, and audit-ready recordkeeping across all files.

As a result, compliance must be embedded into everyday workflows.

When compliance processes are integrated into operations,

risk is reduced while consistency improves.

At the same time, deal flow remains steady and predictable.

Efficiency Protects Time, Focus, and Margins

In a competitive market, efficiency is no longer just about saving time.

Manual processes, duplicated data entry, and disconnected tools

quietly drain resources and increase operational costs.

As margins tighten, these inefficiencies become harder to absorb.

When friction increases, brokers lose more than time.

They also lose momentum, confidence, and repeat business.

For this reason, streamlined workflows are essential for managing volume

without increasing stress, staffing, or overhead.

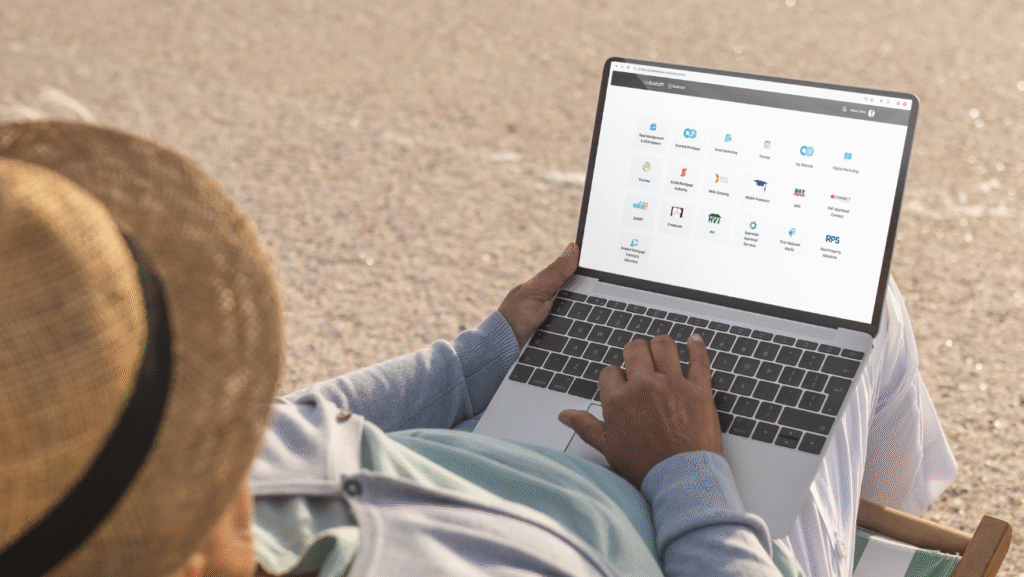

Technology Should Support How Brokers Actually Work

In 2026, mortgage brokers must be selective about the technology they adopt.

While some tools solve isolated problems, others introduce new friction,

which can gradually add unnecessary complexity.

As a result, clarity is often replaced by added operational burden.

The most effective platforms work in the background,

supporting how brokerages already operate rather than forcing major process changes.

By centralizing onboarding, compliance, and operational management,

brokerages gain visibility, consistency, and control as they scale.

Building a Brokerage That Can Scale With Confidence

The most successful mortgage brokers look beyond short-term wins

and focus on building businesses that can adapt over time.

Instead, they invest in systems that support their teams,

protect their clients, and enable sustainable, repeatable growth.

By simplifying complex operational and compliance workflows,

Scarlett Network helps brokerages focus on what matters most.

Ultimately, this leads to stronger relationships,

better service, and resilient businesses in 2026 and beyond.