In today’s competitive lending environment, having a powerful mortgage origination system is no longer optional — it is essential.

As regulatory expectations increase and client demands grow, Canadian mortgage brokers need streamlined processes, reliable compliance tools, and efficient workflow automation to stay ahead. Without the right mortgage origination software, productivity declines and risk increases.

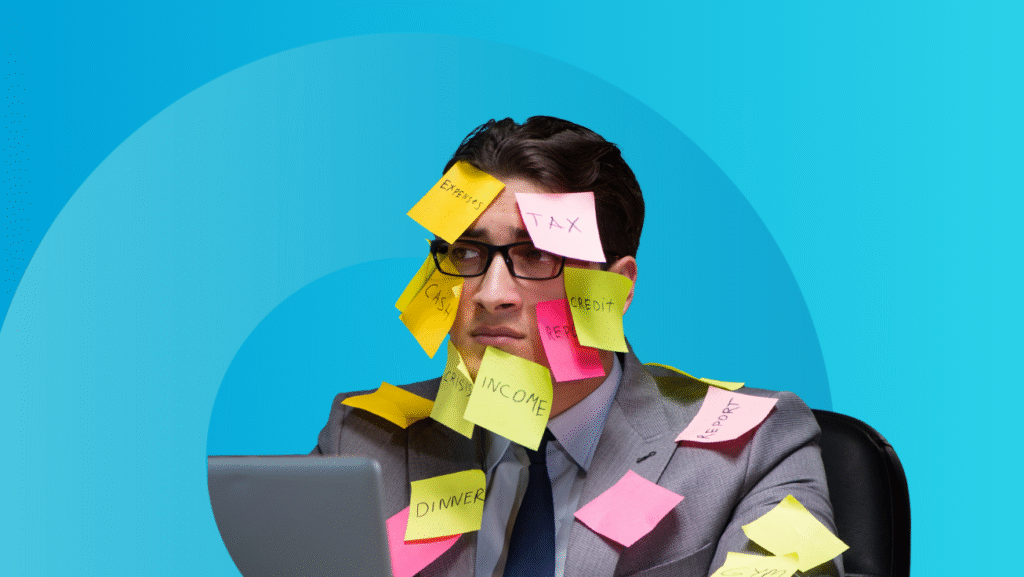

The Cost of Inefficient Mortgage Origination

Manual processes, disconnected spreadsheets, and unclear workflows create operational friction. As a result, approvals slow down, follow-ups get missed, and compliance gaps widen.

In addition, inconsistent documentation increases exposure to regulatory scrutiny. For example, guidance from the Financial Consumer Agency of Canada (FCAC) reinforces the importance of consistent processes and consumer-focused practices.

Over time, inefficient origination impacts growth, compliance, and client satisfaction. That is why many brokerages move toward systems that connect origination, workflow, and follow-up — not just standalone tools.

- Delayed lender submissions

- Increased compliance risk

- Poor client communication

- Higher administrative workload

- Broker and staff burnout

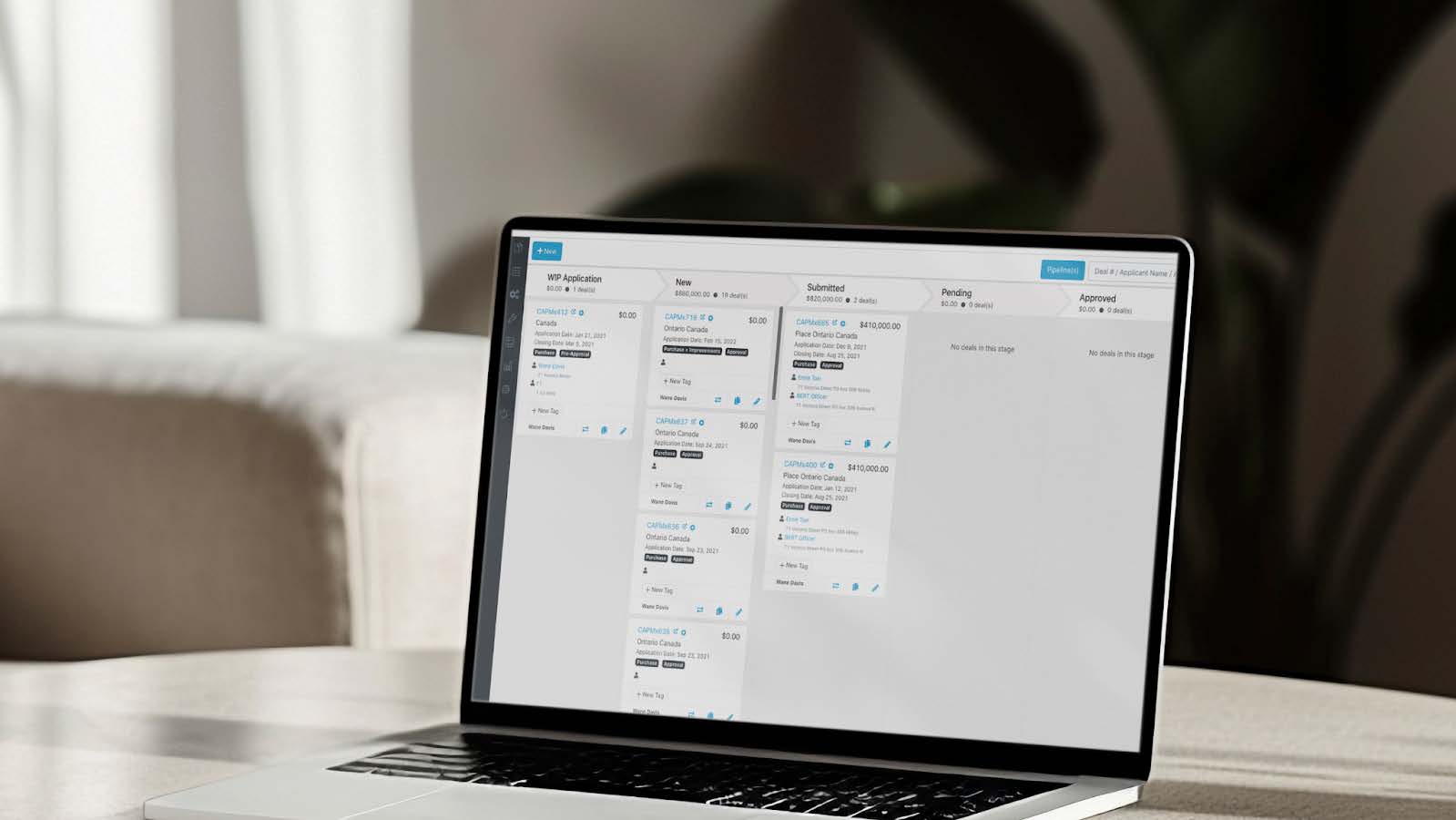

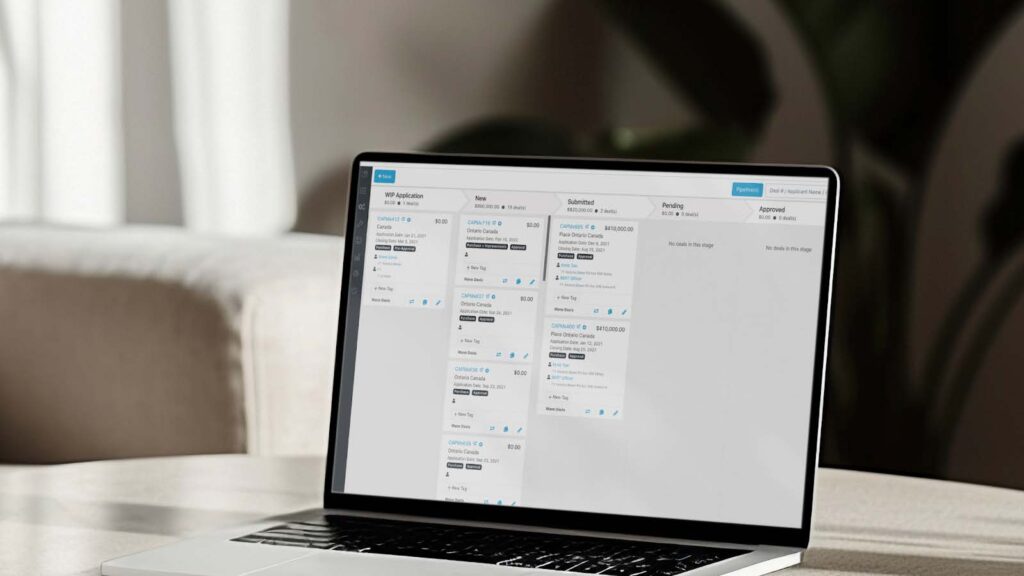

How a Modern Mortgage Origination System Improves Efficiency

The right loan origination system (LOS) should work quietly in the background. Instead of adding complexity, it simplifies daily operations and creates clarity across your pipeline.

For starters, a modern mortgage origination platform helps you:

- Centralize client data

- Automate document collection

- Track compliance checkpoints

- Manage lender conditions

- Monitor pipeline performance

- Improve response times

More importantly, efficiency improves when origination connects with your CRM and automation. Consequently, leads, tasks, and follow-ups stay organized while files move faster.

Supporting Growth Without Broker Burnout

Growth is positive — however, unmanaged growth creates stress. As your mortgage business scales, file volume increases, conditions multiply, and compliance reviews become more detailed.

Without scalable systems, growth can quickly turn into longer hours and declining service quality. That said, brokers who use consistent workflows gain predictability, clarity, and better team accountability.

- Predictable processes

- Consistent file structure

- Reduced duplication

- Automated reminders

- Clear task ownership

As a result, you can handle more volume while still protecting the client experience and your work-life balance.

Compliance and Professional Standards in Canada

Canadian mortgage professionals operate in a tightly regulated environment. Therefore, maintaining structured files and audit-ready documentation is critical.

In practical terms, an effective compliance layer helps standardize disclosures, track document history, and maintain communication logs. For reference, FINTRAC provides guidance for reporting entities here: FINTRAC Guidance.

Likewise, having operational systems that support compliance across your business — including payroll and compliance workflows where applicable — reduces risk and improves consistency.

Why Scarlett Network’s Mortgage Origination Platform Stands Out

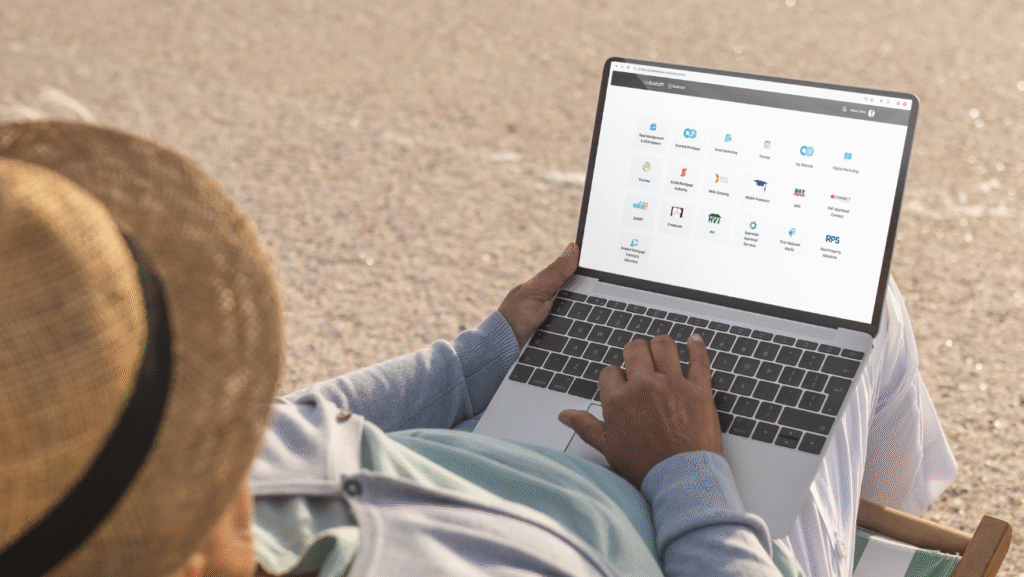

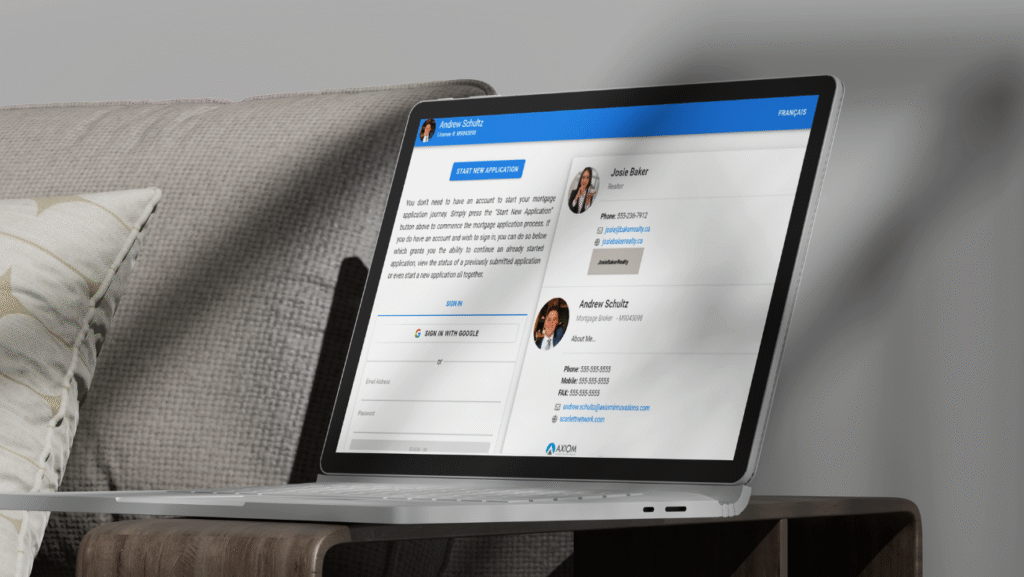

Scarlett Network brings key operational functions into one centralized environment. Rather than layering tools, it connects origination, workflow management, and operational visibility into one cohesive system.

In other words, brokers can spend less time managing process and more time serving clients. With that in mind, you can explore platform options on the Products page, and then book a demo when you are ready.

Ultimately, a strong mortgage origination system empowers brokers to focus on what matters most: relationships and results. In turn, simplifying operations and strengthening compliance creates a more sustainable business.

In today’s market, efficiency is not a luxury — it is a competitive advantage. So, if you want a smarter way to run origination, start with a platform designed for real-world Canadian workflows.