In recent years, the mortgage industry has undergone a significant transformation. Tasks that once required endless emails, manual follow-ups, and stacks of paperwork can now be completed in seconds through automation. According to research and guidance from the Canada Mortgage and Housing Corporation (CMHC), improving efficiency and transparency has become a key expectation for today’s borrowers.

Despite rapid advances in technology, one thing has not changed: clients still want a mortgage broker they can trust. Automation is not replacing that relationship — it is reshaping how brokers and clients work together.

Here’s how automation is changing the broker–client relationship and improving the mortgage experience on both sides.

Faster Answers and Less Waiting

Waiting has long been one of the most frustrating parts of the mortgage process. Borrowers wait for updates, documentation requests, lender feedback, and approvals, often without a clear sense of progress.

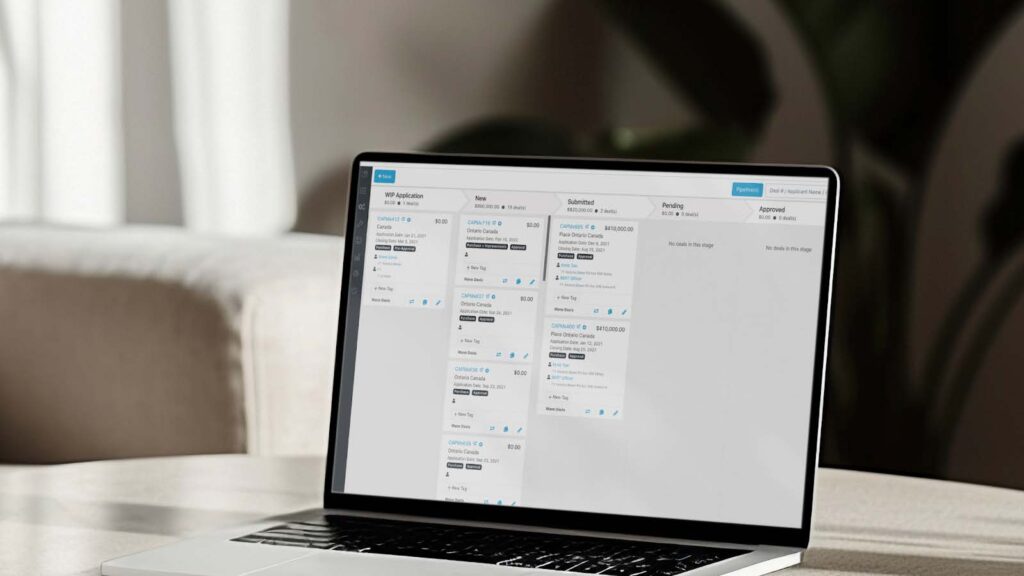

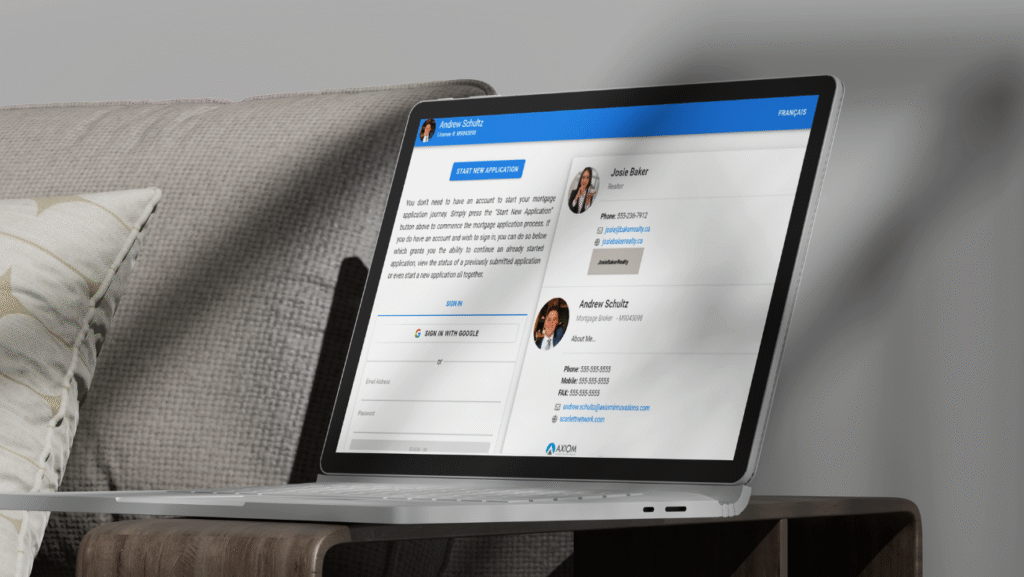

Automation dramatically reduces this uncertainty. With modern mortgage broker technology handling document collection, reminders, lender searches, and real-time status updates, clients stay informed at every stage. Instead of wondering what is happening behind the scenes, borrowers experience a clearer and more predictable path from application to approval.

For brokers, this means less time spent chasing paperwork and more time providing strategic advice and reassurance to clients.

Greater Accuracy and Fewer Surprises

Manual processes increase the risk of errors, from missing forms to outdated figures that can slow a deal or create unnecessary stress.

Automated workflows help reduce these risks by standardizing processes and identifying gaps early. Brokers are able to submit cleaner, more complete files through structured mortgage broker workflows, while lenders receive higher-quality submissions that move through underwriting more efficiently.

The result is a smoother process with fewer surprises for clients and greater confidence for everyone involved.

Personalized Guidance Without Losing the Human Touch

A common concern is that automation could make the mortgage process feel impersonal. In practice, the opposite is true.

By removing repetitive administrative tasks, automation frees brokers to focus on listening, problem-solving, and tailoring recommendations to each client’s situation. A streamlined client mortgage experience allows brokers to spend more time advising and less time managing logistics.

Technology does not replace the broker’s expertise — it enhances it, allowing for more thoughtful, personalized guidance.

Clear and Consistent Communication from Start to Finish

Strong communication is central to trust, and automation helps brokers maintain consistency throughout the mortgage journey.

Automated updates, milestone notifications, and document requests ensure clients always know what to expect next. From a borrower’s perspective, this feels like working with a broker who is organized, proactive, and fully in control of the process.

When communication is clear and predictable, clients feel supported rather than stressed.

A Smoother Experience Across the Entire Mortgage Ecosystem

When background tasks are handled automatically, the mortgage process becomes more transparent for everyone involved.

Clients feel informed and confident instead of overwhelmed. Brokers feel supported rather than stretched thin. Lenders receive better-prepared files that align with industry best practices, as outlined by organizations such as Mortgage Professionals Canada.

Automation creates a more efficient and collaborative ecosystem that benefits all parties.

Technology Enhances the Relationship — It Doesn’t Replace It

Automation is not about removing the broker from the process. It is about removing friction.

At Scarlett, we believe the future of mortgage origination lies in the balance between powerful technology and human insight. With the right systems and a dedicated broker support team in place, brokers are free to focus on what clients value most: trusted advice, clarity, and confidence.

When clients feel informed, supported, and genuinely cared for, the broker–client relationship becomes stronger than ever.