When it comes to mortgages, trust is everything. Clients are making one of the biggest financial decisions of their lives and placing it in your hands. The first 10 minutes of a conversation can determine whether they see you as a reliable mortgage partner or just another salesperson.

Start with Listening

Before you explain products or rates, take time to listen. Ask open-ended questions about their goals, challenges, and comfort levels. Clients want to feel understood, not sold to. Therefore, listening helps you personalize your advice and shows that you genuinely care about their success.

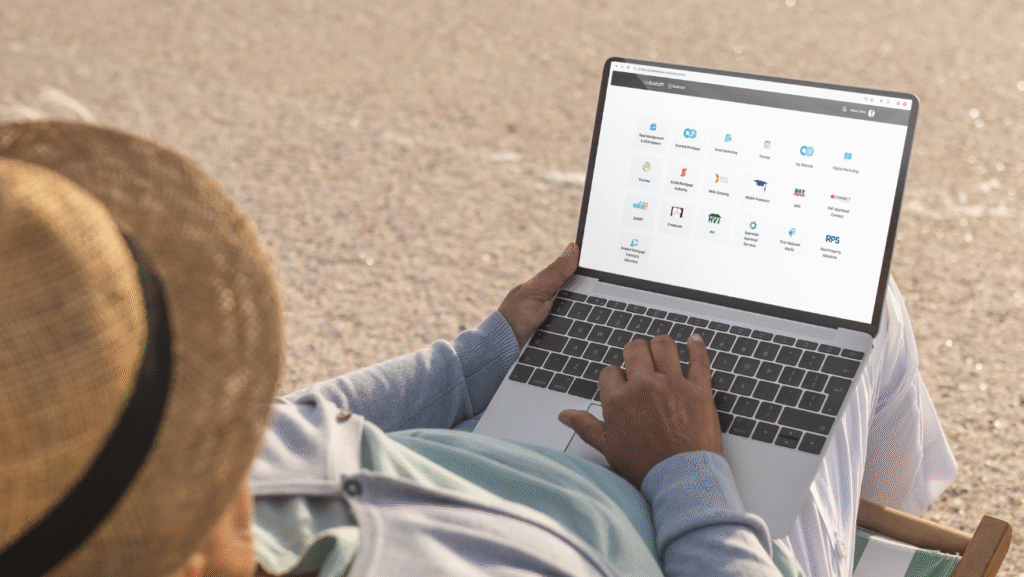

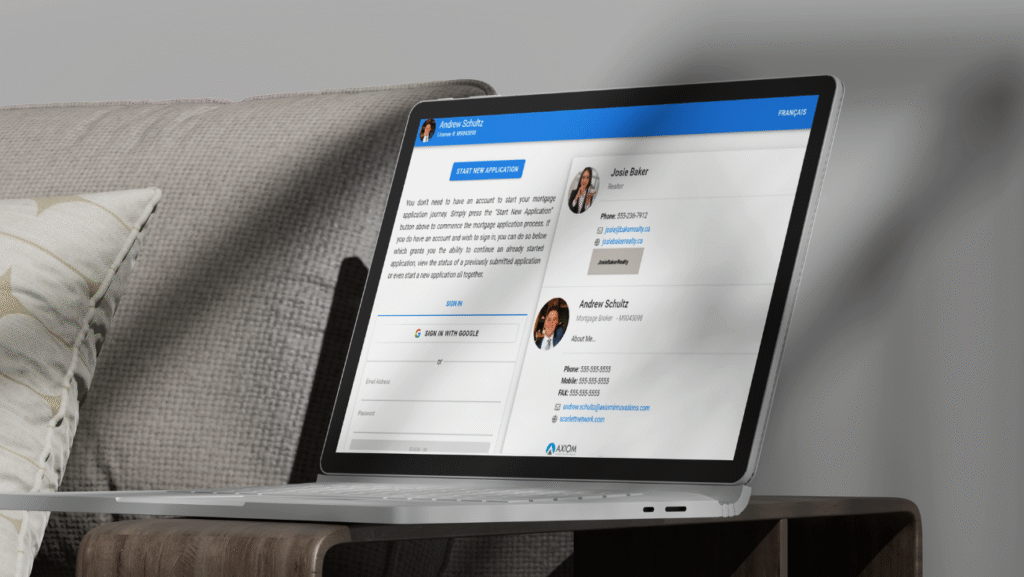

With Scarlett: Integrated client intake tools capture key details automatically, helping brokers focus on meaningful conversations instead of data entry. Learn more on our Features page.

Be Transparent from the Start

Trust grows when clients know exactly what to expect. Explain your process clearly, including timelines, required documents, and potential costs. Avoid industry jargon that can confuse or intimidate. Moreover, the more transparent you are, the more confident your clients will feel throughout the mortgage process.

For details on how digital transparency improves compliance and communication, visit Scarlett Pay or review FINTRAC guidance for Canadian brokers.

Demonstrate Expertise

Clients want to know they are in capable hands. Therefore, share examples of similar client scenarios or explain how you stay informed about changing market conditions. In fact, small details such as being prepared with current rate insights or new policy updates establish credibility quickly.

With Scarlett: Built-in data insights and compliance tracking help you provide accurate, timely information that builds client confidence from the start.

Communicate with Confidence and Clarity

Your tone and body language matter as much as your words. Speak with calm confidence and be direct when explaining options. However, avoid rushing through explanations or overwhelming clients with unnecessary details. Additionally, clear communication reassures clients they are in professional hands.

Pro Tip: Follow up your first meeting with a concise, personalized email using your Scarlett CRM & Automation tools to reinforce professionalism and strengthen client relationships.

Personalize the Experience

Take note of what matters most to each client. Maybe they are first-time buyers seeking simplicity, or investors focused on long-term savings. Use that insight to tailor your approach and demonstrate alignment with their goals. Ultimately, personalized communication creates lasting trust and stronger client relationships.

The Bottom Line

In conclusion, trust does not take months to build—it begins in the first conversation. By listening, being transparent, showing expertise, and personalizing your approach, you set the tone for a long-term partnership built on confidence and reliability. Discover how Scarlett Network helps brokers strengthen trust through smarter workflows and transparent communication.

Keywords: Scarlett Network, mortgage broker trust, building client confidence, mortgage communication, client relationship management, FINTRAC compliance, Scarlett Pay, mortgage technology Canada, digital transparency, CRM automation tools, broker workflow software.