How Mortgage Brokers Can Prepare for a Strong Year Ahead

A new year brings new opportunities — and new challenges — for mortgage brokers running growing businesses. Markets shift, client expectations evolve, and competition across the mortgage broker industry continues to increase. According to insights from the Bank of Canada, changing economic conditions and interest rate environments continue to shape borrower behaviour.

The brokers who thrive aren’t the ones who simply work harder, but the ones who prepare smarter. That preparation starts with tightening systems, sharpening focus, and ensuring your mortgage brokerage is ready for whatever the market throws your way.

Here’s how mortgage brokers can prepare for a strong year ahead.

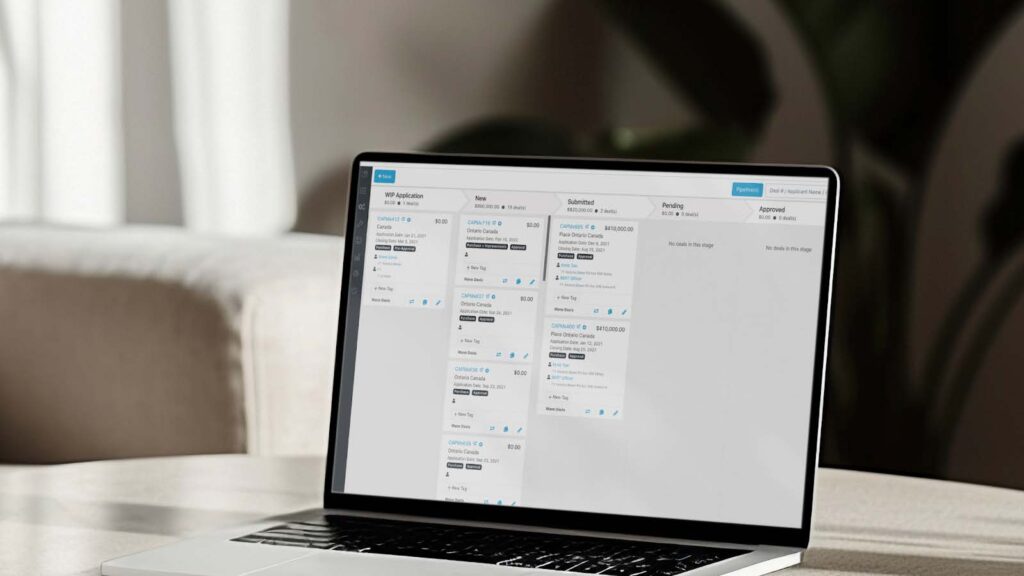

Get Your Mortgage Broker Systems Dialed In

Before new mortgage applications start rolling in, take a close look at how your business is running behind the scenes. Strong mortgage broker systems help keep files organized, follow-ups consistent, and workflows running smoothly — especially as volume increases.

Start by asking yourself a few simple but critical questions. Are your files clearly organized and easy to access? Are your follow-ups consistent and timely across every deal? And do you have a clearly defined process that guides clients from first contact through to funding?

When these foundational pieces are in place, your systems support you instead of slowing you down — making it far easier to handle increased volume with confidence.

Review What Worked (and What Didn’t) in Your Mortgage Brokerage

The previous year holds valuable insight if you’re willing to review it honestly. Taking time to assess your performance helps you understand where your business ran smoothly and where friction appeared.

Look closely at which referral relationships delivered consistent value, where deals tended to stall or fall apart, and which tasks consumed more time than they should have. Understanding how deals moved through your mortgage broker workflows allows you to refine your approach before the same issues repeat themselves.

Identifying patterns early helps you double down on what’s working and correct inefficiencies before they compound over the course of the year.

Refresh Your Mortgage Broker Client Experience

Clients remember how you made them feel — especially during a stressful process like getting a mortgage. Research and consumer insights from the Canada Mortgage and Housing Corporation (CMHC) consistently highlight the importance of transparency, communication, and clarity for today’s borrowers.

A strong client experience means borrowers always understand what’s happening next, why decisions are being made, and where they are in the process. Clear expectations, proactive communication, and predictable timelines build trust and confidence.

When clients feel informed and supported, they are far more likely to return in the future — and to refer friends, family, and colleagues.

Set Clear, Realistic Goals for Your Mortgage Business

Ambition is important, but clarity is essential. Vague goals such as “do more deals” offer little direction when things get busy.

Instead, define what success looks like for your mortgage brokerage this year. That may include a target number of funded files, faster turnaround times, deeper lender relationships, improved operational efficiency, or better work-life balance.

Clear goals provide measurable benchmarks and help guide day-to-day decisions throughout the year.

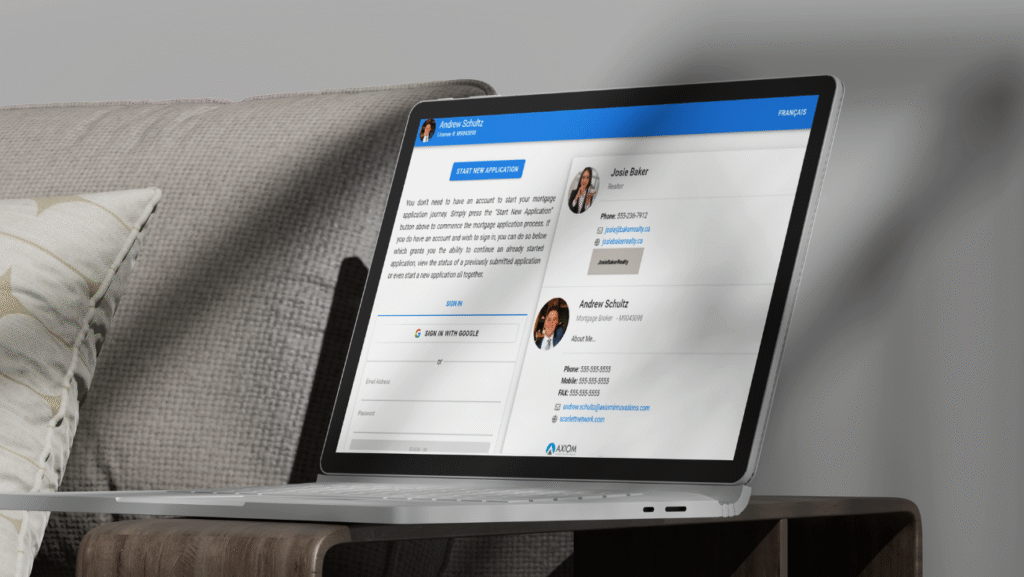

Invest in the Right Support and Mortgage Broker Technology

No mortgage broker succeeds alone. As your business grows, the need for reliable support and efficient systems grows alongside it.

Modern mortgage broker technology plays a critical role in reducing friction, improving accuracy, and supporting consistent service delivery. Whether it’s administrative support, workflow automation, or a centralized platform that keeps everything organized, the right tools allow you to focus on advising clients and closing deals.

With the proper support structure in place, your business becomes easier to manage, scale, and sustain.

Start the Year Proactive, Not Reactive

The brokers who gain momentum early in the year are the ones who plan before things get busy.

Proactive outreach to referral partners, reconnecting with past clients, and preparing marketing materials in advance helps establish early momentum. When activity increases, you’re responding from a position of readiness instead of scrambling to catch up.

Momentum built early in the year often carries through the months that follow.

Preparation Creates Confidence

A strong year doesn’t start with the first deal — it starts with preparation.

When your mortgage broker systems are organized, your goals are clear, and your support structure is in place, you enter the year with confidence instead of chaos. That confidence shows up in client conversations, lender relationships, and ultimately, your results.

At Scarlett, we believe the most successful mortgage brokers are the ones who combine strong preparation with the right systems, tools, and support. Backed by a responsive broker support team and informed by trusted industry insights, your technology works for you — not against you — freeing you to focus on growth and make the most of the year ahead.